August 8, 2025

Things I Learned This Week on Earnings Conference Calls

Announcing Q2 earnings means guidance for the second half of the year and maybe some insights into next year. That is the drill. Historically, capital spending, as well as rig and frac counts, have been higher in the second half of the year compared to the first half. Not this time. The seasonality model that has worked so well for decades has faced headwinds over the last couple of years and this year is no exception. Four to five years of increased activity, followed by a correction and a strong recovery was what we saw for years.

Mixed Bag. E&Ps are spending less, but production is slowing at a more gradual pace, meaning they are doing more with less. And that “less” is lower capex, which is the revenue of OFS. OFS companies have understandably been very cautious, focusing on what they can control. But the real challenges are in external factors like pricing and demand. Prices for services are falling. In a downcycle, earnings rarely get revised just once. A truism that clouds the future. Midstream, on the other hand, should continue to perform well since volumes, especially for natural gas, are expected to rise even if prices don’t. Buckle up. It is still too early to see any light at the end of the tunnel.

Landman. This week was the AAPL and Texas Land Institute meeting, and they had to listen to me at lunch. I listened to the speakers too. One guy talked about AI. His company curates databases to make sure you aren’t getting garbage out. Then they build a model and system to optimize it. Curated is becoming a big deal. We wrote about it over the last few weeks, about all the companies hiring summer help and bringing in all hands to collect, verify and organize data. Curated, so it can be used in AI models. It is not a positive development at all for management consultants, especially the big ones. He also explained how AI helps in the land management business when you use the right models and the data is good. Briefly. Once my data is fully “curated,” all I have to do is tie current reporting to model input. It is a big project, but once it’s done, it is mostly done. It is tedious to do.

Prompts. I got an education on “prompts.” AI prompts are instructions given to an AI to generate a specific output, acting as a bridge between human intention and machine execution. They can range from simple keywords to complex instructions and the quality of the prompt directly impacts the AI's response. Effective prompting involves clear communication, providing context and potentially offering examples, all aimed at guiding AI to produce the desired outcome. One speaker had the audience do a check. He asked them to input the following question. Try it.

“I’m a Landman who focuses on X. Give me ten specific ways I can start using AI to make my job easier and more efficient. Focus on functionality you have right now.

The number of functions AI can automate is its biggest positive and negative. Efficiency versus headcount. It will be a challenge. “Technology and evolution are moving so quickly that any bad experience you had or disappointments using AI may already be gone, as it is constantly changing, even if it was last month.”

PPHB U.S. Energy Market Highlights:

Commodity Prices: WTI crude oil is currently $64.35 per barrel (down ~7.1% week-over-week) and natural gas is $3.08 per MMBtu (down ~0.9% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.3 MM BOPD (down ~0.9% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories decreased by ~3.0 million barrels week-over-week vs. an estimated increase of ~0.2 million barrels.

Frac Spread Count: There are currently 167 frac spreads operating in the U.S. (a decrease of 1 spread week-over-week).

Onshore Drilling Rig Count: There are currently 525 drilling rigs operating in the U.S. (a decrease of 1 rig week-over-week).

Snippets.

LNG: Commonwealth LNG has contracted Technip Energies to provide engineering, procurement and construction services for Commonwealth’s 9.5 million tonnes per annum LNG facility under development in Cameron Parish, Louisiana.

2Q Takes: The focus is shifting from growth to balance sheet strength as major companies now require oil prices to be $70-90/bbl to fund buybacks, which is pushing leverage higher. BB favors TTE (new best ideas addition), ENI, GALP and CVX with upcoming CMDs and divestments seen as potential catalysts.

Nat Gas Opinion: “Natural gas production is déjà vu all over again. High salt stocks and record production overwhelmed the fourth hottest June and July in the past 30 years, pushing gas prices to YTD lows. We lower our balance of 2025 gas forecast to $3.0/MMBtu, as recent rig adds put natural gas stocks on pace to exceed 3.9 Tcf this fall. The risk of increased hedging activity, growing gas production, solar adds and continued coal use supports our $4/MMBtu price outlook, despite LNG demand growth.” - Bank of America

A Win! We have written about the effort by Jim Flores and his Sable Offshore Project off the coast of California. Ten years ago, the Santa Ynez Unit was shut down due to an oil spill. Exxon was the operator and after years of trying to reactivate the project, it sold the asset last year to a new Houston-based company formed for this project. There are approximately 190 million barrels of recoverable oil reserves within this area, which account for nearly 80% of residual Pacific reserves and about 3% of the total production potential for the United States. The field is now producing from the Harmony Platform and the company is working with the Department of Interior, rather than the California state government alone, to bring additional production online later this year. A second producing platform could add another 10,000 barrels of oil per day. Why write about it now? It is hitting headlines. “This is a significant achievement for the Interior Department and aligns with the administration's energy dominance initiative, as it successfully resumed production in just five months. We've turned a decade-long shutdown into a comeback story for Pacific production. In just months, BSEE helped bring oil back online safely and efficiently - right in our own backyard. That's what energy dominance looks like: results, not delays.” What a difference a change in leadership can make.

Blowin’ in the Wind. “Allen Brooks describes how the Interior Department is applying the full scope of government agency approval regulations to major offshore wind projects, rather than cherry-picking regulations as the Biden administration allies tried to do. The result could be a significant shift in how many offshore projects actually move into development. These projects were already struggling, with costs and interest rates making them questionably economic at best. With added regulation and longer development timelines, most of them will likely disappear, although perhaps not before facing heated litigation. The parties aiming to deliver the resulting power would have to ramp up subsidies and prices to absurd levels. However, never doubt the ability of politicians to be ridiculous.”- my friend James Halloran.

Work Hard. The Energy Workforce & Technology Council released its July 2025 jobs report. Total jobs in the sector declined slightly to 633,938, a month-over-month decrease of 1,852 positions from June. At the national level, the U.S. economy added 73,000 jobs in July, well below expectations, while the unemployment rate held steady at 4.2%, according to data released by the Labor Department. The slowdown reflects ongoing uncertainty driven by trade policy shifts, inflationary pressures and global economic headwinds. “While we continue to see a modest recalibration in energy services employment, the sector remains stable and focused on long-term growth. Our members are preparing for the next phase of growth and continuing to deliver the critical expertise that powers American energy security,” said Energy Workforce President Molly Determan.

Market Oil. ConocoPhillips is selling its Anadarko Basin assets it acquired through its $17 billion Marathon Oil acquisition last year for $1.3 billion. The assets include about 300,000 net acres in Oklahoma’s SCOOP/STACK plays, with production averaging about 39,000 barrels of oil equivalent per day (~50% natural gas). The buyer was not disclosed, but the deal is expected to close in Q4. This sale puts Conoco ahead of its divestiture goal, which has now been raised to $5 billion by the end of 2026.

Snippets Part Two.

The Bank of England lowered its lending rate by 25 basis points to 4%, while India left its rate unchanged.

Expand Energy reports that efficiency gains will allow executives to trim capital expenditures by $100 million.

Most of the 73,000 jobs in July came from healthcare, with 55,000 in total. Ambulatory healthcare services added 34,000 jobs and hospitals added 16,000. Average hourly earnings rose 0.3% month-over-month, as expected, and 3.9% year-over-year, slightly higher than expected.

The Lava Ridge Wind Project, approved in December 2024 by the Biden administration's Bureau of Land Management, was expected to be a 1,000-megawatt wind farm with up to 231 wind turbines across nearly 57,447 acres in southern Idaho. It has now been cancelled by the administration.

Buying/Selling Water. Western Midstream is growing its water business through the acquisition of Aris Water Solution for $1.5 billion. Aris went public in 2021 and was one of the first and only water-focused companies to complete an IPO in the last few years. The same team behind Solaris Infrastructure Solutions launched Aris. Including debt, the enterprise value of the transaction is about $2 billion. Aris operates a 790-mile produced water network in the Permian Basin and will expand Western Midstream’ s footprint into Lea and Eddy counties in New Mexico. “The combination of our assets creates a leading produced water gathering, disposal and recycling business that can meet the flow assurance needs of customers as they execute on their decades' worth of drilling inventory,” said the CEO of Western Midstream.

Wasting No Time. Flowco went public in January of this year and no grass is growing under management’s feet. Flowco is a provider of production optimization, artificial lift and methane abatement solutions. The company announced that it has completed the acquisition of High-Pressure Gas Lift (“HPGL”) and Vapor Recovery Unit (“VRU”) systems from Archrock for about $70 million. “We are pleased to announce our first M&A transaction, delivering on our strategy to grow inorganically. This transaction underscores our disciplined approach to M&A, focusing on opportunities in production optimization at attractive valuations,” said the CEO.

Data This Time. Business combinations continue, but they have not followed the strategic consolidation path many expected. Blackstone is acquiring Enverus, the oilfield data group we all use these days, especially as industry wide reporting of key information has been largely abandoned. Enverus was owned by Hellman & Friedman and Genstar Capital. With roots going back 26 years, the company is now the largest and fastest-growing SaaS and analytics provider dedicated to the energy market, serving more than 8,000 customers across 50 countries. “This is more than a transaction – it’s a launchpad. Blackstone shares our conviction that the future of energy will be defined by AI, real-time intelligence and bold execution. Their global reach and deep expertise across energy, infrastructure and data-rich industries will accelerate our growth,” said the CEO of Enverus.

People waiting in line in Kalispell, Montana for their Huckleberry Milkshakes. It’s a thing. A BIG thing.

Taking on Risk. Risk managers from around the state met in San Antonio this week for the Risk & Insurance Management Society’s conference (RIMS is a 75-year-old organization with 10,000 members). According to Bloomberg, demand for risk management specialists is expected to go up, with 54,000+ new U.S. jobs by 2029, according to Recruiter.com. Most in attendance work for private companies with an additional handful in the public sector and they are charged with preparing for a wide range of hazards - from cyberattacks to major litigation to natural catastrophes like floods and hailstorms. These are jobs AI won’t take. At least not right away.

When Israel is Needed. Egypt has signed a $35 billion export agreement with Israel to buy 4.59 trillion cubic feet over the next 14 years from the Chevron-operated Leviathan Gas Field, a whopping 22% of the field’s reserves. Egypt has bought about 829 Bcf over the last four years. It is easily the largest export agreement in Israel’s history and demonstrates the strength of having significant oil and gas reserves as well as an ability to put economics before politics. The deal starts at about 700 Bcf in 2026, which will only increase following the completion of a new pipeline from Israel to Egypt. Like the U.S. in the coming years, Egypt, the Middle East’s most populous country, has already experienced rolling power blackouts, forcing the need for a deal with Israel.

OPEC+ Pours It On. As of September 3rd, all 2.2 million barrels of oil taken off the market in November 2023 will be back on the market. The eight major players of OPEC+ (Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria and Oman) will put 547,000 barrels back on the market, a massive increase from the previous count of 112,000 barrels only four months ago.

Bingo. BP has made its largest oil and natural gas discovery in 25 years off the coast of Brazil. While they did not give any reserve information, they said it was bigger than Shah Deniz, which was discovered in 1999 and once held around 1 trillion cubic meters of gas and 2 billion barrels of condensate. A few years ago, BP shifted its focus to a “greener” agenda and started making investments in “green” companies and technologies to reduce its dependence on oil and gas. That came to a screeching halt last year when investors rebelled and told BP to get back to doing what it does best. Or at least something with higher returns than the “green” businesses. After years of Guyana being the center of attention and Brazil recovering from scandalous headlines, it seems the original deepwater market is back open for business. Not only is there still significant production, but also huge remaining potential, as demonstrated by BP. There will likely be other companies that follow in their footsteps. The offshore players in Brazil include the national oil company Petrobras, Shell, TotalEnergies, Equinor, ExxonMobil and Chevron. Deepwater drilling has been improving for the past 6-8 quarters and will continue to largely in part due to the activity in Brazil.

Sand. It is a tough market. There never was a shortage of sand in the Permian Basin once we realized we could use that instead of Northern White. The resulting boom put many players on the map as sand use skyrocketed with extended laterals and increases in drilling. And it wasn’t just the Permian. The Eagle Ford, Haynesville and every other basin saw a big increase in demand. Fast forward to today, the rig count and frac spread count are down and we are not at all short of sand. The result? Pricing declines. So, it should be no surprise that a sand company filed for bankruptcy this week. FCI Sand Operations, LLC and FCI South, LLC filed for Chapter 11. They operated primarily in the Eagle Ford.

Money Gone. Money has been hard to come by for our industry with the heads of states, the UN and others pushing financial institutions to quit lending to fossil fuel developments. But it is difficult to tell whether that is a current issue or if spending is simply down and less financing is needed. Regardless, financing provided to oil, gas and coal projects by Wall Street’s top six banks fell 25% to $73 billion from last August, according to data compiled by Bloomberg. The biggest decline was at Morgan Stanley, where fossil-fuel financing dropped 54%. The smallest was at JPMorgan Chase & Co, which saw roughly a 7% decline. According to JPMorgan, it should be the first decline in global upstream oil and gas development spending since 2020.

This Is Big! Energy Transfer has approved a $5.3 billion project to expand its network in the southwestern U.S. with the Desert Southwest Project, which will add 516 miles of 42-inch diameter pipeline capable of flowing 1.5 Tcf of natural gas per day. What is different? It is going in a different direction than all the other pipes announced. This one heads west to Arizona, not a Gulf Coast LNG plant! Completion is expected in 2029.

The Goal Now. I read a piece today where an analyst acknowledged that May oil production set a record and it was offshore production that caused that, not shale (which was basically flat). From there, the doomsday scenario developed. That is like being shocked that the midway games at the fair are actually rigged! The ability of the industry to flex its activities in the most productive areas and to maintain and grow production has been stunning for years. The North Slope dropped from 2 million barrels to less than a quarter of that, Exxon and Chevron dominate West Texas and the best gas wells are now in Ohio? Ten years ago, this wouldn’t have been understood. I am not saying that U.S. production will continue to grow. I think it has likely hit its peak. But the industry’s ability to maintain that level of production is an amazing feat that leaves me confident in whatever comes next.

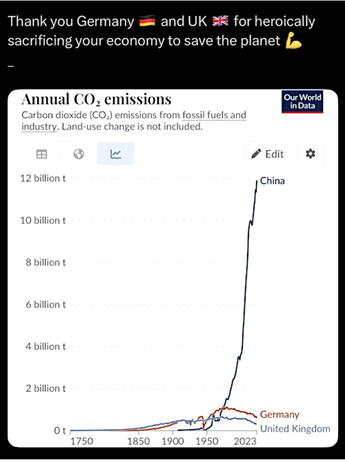

In my years of experience, I have seen similar charts and they are always wrong because of some unexpected events like Shale. Take this with a grain of salt.

Education. This is from a former Federal Reserve bank president. It should be required reading.

Public Ignorance and Fed Independence

“Much ink has been spilled in recent weeks, and hours of cable news spent, debating whether the Federal Reserve’s independence is under political threat. But lost in these debates is an equally dangerous challenge: People often misunderstand what the Fed does and what it legally can’t do. That misunderstanding poses a hidden threat to the institution’s independence.”

“Early in my tenure at the Fed, I sat down with a group of protesters to hear their concerns. One man in particular stood out. Passionate, persistent and frustrated, he made clear that he held a Ph.D. in economics from a major university. He insisted that the Fed provide loans directly to struggling nonprofits and community organizations. I interjected to explain that doing so would be illegal. Congress hasn’t authorized the Fed to lend to those groups, only to banks and financial institutions under certain conditions. He seemed genuinely surprised.”

Partial 2Q 2025 Earnings Summaries.

Independent Refiners

Marathon Petroleum - solid refining = EPS beat; doubling down on midstream growth.

Integrated Oil & Gas

BP - Solid operations. Performance drives EPS upside; Brazil discovery adds to optionality. EBIT line was beat by 13% and net income was beat by 29%. CFO (Ex-W/C) was $7.66bn vs RBC $6.23bn. The beat driven by stronger results in gas & low carbon and products segments as well as lower corporate costs. A BP Berenberg analyst says the company's “significantly stronger” Q2 results, combined with recent positive exploration news flow, make for much better medium- to longer-term prospects for BP's upstream business.

Midstream Suppliers

MPLX L.P. - Mixed; EBITDA just below RJ/Street, Northwind Deal adds to Permian growth, 2Q EBITDA of $1.690B was slightly below Street consensus of $1.704B by 0.8% and RBC estimate of $1.697B by 0.4%. Crude oil and products logistics beat higher overall volumes and average tariffs. NG and NGL services missed lower G&P volumes.

ONEOK - Mixed print; 2025 range reiterated, but 2026 haircut in focus; 2Q EBITDA slightly (0.6%) below Street estimates but they reaffirmed their 2025 guidance.

The Williams Companies - Mixed print, 2025 guidance increased on Saber add, 2Q EBITDA was slightly below (~0.4%/0.3% miss) Street/RBC estimates and WMB raised the low-end of its 2025 EBITDA guidance range ($50MM higher at the midpoint) which is still slightly below Street consensus of ~$7.723B.

Utilities and Power

NRG Energy - Mixed - adjusted EBITDA just missed RJ/Street, but trending at the upper end of 2025 guidance range.

The Southern Company - Solid print, reiterated guidance, catalysts remain as capital plan increases.

Oilfield Services and Equipment

Archrock - Underappreciation of natural gas demand growth, independent of weakest oil fundamentals.

Atlas Energy Solutions - Still suffering from weaker Permian, while supply/demand sorts itself out.

Select Water Solutions - Nice 2Q print/water infrastructure contract adds, 2H25 guide a bit weaker than feared.

Tidewater - Steady guide after strong 2Q, 2026 shaping up for improvement; $500m buyback + M&A potential.

Noble - Messaging on the call suggested a positive outlook for offshore fundamentals in late 2026, albeit with a more cautious near-term tone than its peers.

Patterson-UTI - GAAP EPS of -$0.13 misses by $0.09, revenue of $1.22b beats by $10m. Completion services are better than feared. Slightly positive as adjusted EBITDA of $231mm and implied guidance of ~$210mm for 3Q are both a hair above published consensus and better than feared. Net capex is now expected to be less than $600mm vs ~$600mm previously to reflect slightly lower activity.

FMC - Results beat; subsea project list grows. Adjusted EBITDA of $509mm beat consensus by +7%, FCF of +$261mm was much better than expectations of negative $186mm, and subsea orders of nearly $2.6b beat the $2.4b consensus by +6%. Subsea services hit one of the highest quarterly levels ever achieved.

Baker Hughes - Orders and EBITDA beat; Industrial & Energy Technology (IET) orders beat consensus by 6%-10% without any major LNG awards and included ~$550mm of equipment for data centers. Revenue and adjusted EBITDA beat by +4% and +8%, with better margins in both IET and OFSE. Reinstated full-year OFSE guidance essentially matches consensus and implies an adjusted EBITDA margin of 18.5% vs 18.4% last year. Management is confident in achieving full-year order guidance of $12.5b - $14.5b (consensus $13.9b).

Weatherford - Quarter down the fairway; encouraging guidance. Revenue and adjusted EBITDA beat the street by +3% and +1%, albeit with mixed results at the segment level. Guidance for Q3 and Q4 EBITDA is 3% and 15% respectively. Mexico plans to issue $7 - 10b of dollar-denominated asset-backed securities that help fund their arrears including those to WFRD. Full-year 2025 FCF guidance is unchanged and implies ~$410mm at the midpoint versus the $365mm consensus.

Oil States - Offshore and international demand, strong backlog, and margin discipline support Oil States International’s outlook, but U.S. land activity weakness tempers near-term gains.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.