May 30, 2025

Things I Learned This Week on Bourbon Street

Okay, most of everything I learned in New Orleans was gleaned from the Conference, but Dragos and Antoine’s got some “due diligence” as well. The LEC was this week in New Orleans. 500+ attendees. Congrats, Al Petrie, on the 25th year of the Conference. I watched, listened and learned. And I got to do a panel with just me and Marshall Adkins. David Preng introduced us, and Al moderated us. Both had a really hard time getting us to talk. We are both so shy.

Permian Volatility. The goal is to spend enough to hold production basically flat with the remainder of cash being used to pay debt. No one wants low oil prices, but one public executive noted that their Permian breakeven oil prices are between $30 and $35 on drilling alone, with the all-in cost sitting around $50. Organic growth is more of a focus today. Debt has been reduced dramatically over the last four years. Cash flow is still positive. Activity may slow some under the current oil prices, and the Company will be dropping one of three rigs, positioning for future A&D activities. Gas takeaway is still an issue and doesn’t always contribute to cash flow. Water handling is a big deal, a key component to keeping costs down, using SWDs. Power is another big issue.

The Current Market. Limited deal flow, projects put on hold. Private equity still doesn’t have a monetization window. Everyone is still pursuing deals, but it’s challenging with few sellers looking to sell at current prices. There is still a pipeline of deals that will come from the majors as they decide what their core ownership should be. It is coming, and there have been a few deals, but many more are expected. There could be more competition for some deals as funds have been able to raise money and need to put it to work. More competition, at least on the Central Basin Platform.

Getting Better. Improvements in drilling and completion. Efficiency? Two opportunities… Data sets are huge. Internal innovation, data mining, a lot of availability to make leaps and bounds in the development of technologies. There is also the potential to leapfrog in technology due to the collaboration between operators, speeding innovation. The efficiency is expected to continue as AI streamlines operations, but the lower rig count and shortage of people could slow operating efficiency gains for a bit. The near-term looks less positive with the consensus currently expecting 25 to 50 more rigs idled by year-end.

E&P Valuation. “If you focus on exploration you have to have a longer time horizon. The U.S. exploration is more about engineering work to be more efficient with the least amount of dollars to improve returns. You will find the hydrocarbon, but is it economic?” – Jeff Robertson, an old friend and a good analyst. What will get investors back into energy stocks? A stable commodity price, increasing earnings and positive returns. For several quarters in a row.

Come Back. U.S. consumer confidence rebounded sharply this month from a 5-year low with tariff threats receding. The gauge of confidence increased by 12.3 points to 98, the biggest monthly gain in four years, and increased at its fastest rate in over 13 years. The increase in confidence was broadly seen, across age, income groups and political affiliations, with the strongest gains among Republicans.

E&P Stocks? Commodity price stability is needed, but if the oil price stays flat and production goes down, why buy the stocks? A new development of doing something different or better makes you stand out. Increasingly interesting. And the problem is that, normally, when production drops, prices move up but if our shortfall is compensated for by higher production elsewhere, prices may not move. A big concern to investors.

What Happened to BP? The Shell/BP rumored merger has not happened (yet) but they have been busy. This week, Shell paid $510 million to TotalEnergies for its 12.5% interest in the Bonga oil field, which is located offshore Nigeria. Drop in the bucket. We will see.

Where is Private Equity Going? Industrial dewatering, data centers, power systems and electrical controls are getting attention. Not energy transition, but energy and power development. Traditional oil and gas still matters and so does “transition and sustainability.” For OFS, manufactured equipment is still popular, whereas more services-focused companies are not as good. EV/EBITDA multiples are around 3x. Where has AI played? Question of the day. The massive amount of data our industry generates and the multi-variable complexity is ideal for AI which could change the game for the industry. I agree. Better usage of manpower is a big benefit. Elimination of waste, more efficient. If you aren’t adopting it, you will fall behind. We are early in the adoption of AI, but the acceleration will be amazing. Screening and evaluating deals will be a big use case.

There are Other Basins. Drilling wells in the DJ Basin in just four days. Making good money at $60. Is the volatility of all the different tariffs and other issues influencing operations? Wells often cost $5 million, aided by unbundling OFS services and equipment. Many OFS companies are operating as a general contractor, insulated from tariffs by an all-U.S. supply chain. More reductions on lease operating costs, a goal of 15% improvement in efficiency through cost reduction. Integration and scale are what makes things work best. Vertical integration and scale allow for control of the cost structure. Mature basins in California and Utah have seen price hikes in tubulars, but they have enough inventory. A bottleneck getting the oil out of Utah is a problem, but a couple of projects are planned. Hedging to protect cash flows in the current market is popular. Everyone wants the lowest cost of capital, and it is a great industry-wide goal. 60% to 75% hedged for the current year is especially common on the natural gas side, but one crude oil company that is focused on development programs is 85% hedged.

Ouch! Chevron to lay off nearly 800 workers in Permian Basin.

Returning Capital. Has softening in the sector changed your view? Four key principles on one company’s view; Dividends ranging from 7% to 25% of free cash flow. This company also bought 4% of their stock back last year. Balancing growth and returns are the main challenges. Growing equity value is the goal, in whatever manner possible, and organic growth is the best way to grow that value. They plan to use excess cash to fund dividends and M&A opportunities. AI should improve operational capabilities, but right now it is mainly a way to present known data. A monkey that regurgitates information in different ways rather than making decisions. A large language model, the AI models we currently use, might be eclipsed by the decision models that are coming, as a way to get real insights, not a prettier PowerPoint.

Adding On. ADNOC Drilling, which already owns 129+ rigs, is buying a 70% stake in SLB’s Kuwait and Oman land rig business for $112 million, with $21 million of that based on operational performance. It includes six rigs in Oman and two in Kuwait. It’s a step out from history, with only one Jordanian rig ever being acquired by ADNOC.

Hold Up. I did not realize how dominant solar power had become in California, supplying almost half of the power needs for the state between 8am and 4pm. The state has gone from 9.7 gigawatts ten years ago, to 28.2 gigawatts today. The point? The state is having to curtail power generation from renewables to make way for natural gas-fired generation, which must stay online during the day to comply with NERC reliability standards and to have it ramp up in the evening as demand increases from people coming home from work. The chart below shows curtailments, not growth or capacity. As much as 93% of power curtailments were solar.

Alternative Sources of Funding. Acquisition financing has been the reason that most of the capital has been raised. Then OPEC increases production causing so much uncertainty, no one wants to get deals done. Development capital has dried up with oil prices. Energy efficiency will do well in this environment, but the traditional industry has seen difficult financings. Downstream and midstream financing is getting more attention than traditional oil and gas. We didn’t know what data centers were five years ago, but it is a sector that has seen a great deal of capital interest. To deploy capital today, you need to be innovative and think outside the box. Successfully unique is the “Holy Grail.” Most banks can’t handle the volatility of traditional energy. Since mid-2023, deals have become more credit issuer friendly. $10 billion is chasing upstream credit deals. Banks are short-funded, leading to private credit opportunities. 10 to 12 players lead the group and are looking for deals.

OFS: Key Areas of Interest. AI is the recent buzzword, and the industry is starting to integrate it into workflows. They are using it primarily as quality assurance and quality control, rather than using it for the bulk of work. Danos is using it for administrative and contractual issues as well as labor procurement. They are also using it a lot for IT, geothermal, bottom hole tool utilization, repairs and refurbishing. AI helps make better decisions. Inventory and materials are a big part of costs, so AI is being used to examine supply chain issues. Employee care and development remain top priorities for service companies. Small companies can respond quickly.

In the Chips. Nvidia data center revenue soared by 73% to $39.1 billion in the quarter. This doesn’t yet include the 500,000 chips President Trump is letting Abu Dhabi buy. It shows the growth in the data center business.

Key People. Now that we have them through the front door, it becomes critical to keep them. The “digital twin” concept is growing very quickly. That reduces the need for refurbishment. The people we need in the industry going forward are technical people, and not just in the geoscience or mechanical aspects. We are short people. There continues to be a big push to bring younger people into our business. The best way to “go green” is to work for an oil or oilfield services company and continue the efforts already underway.

International Exploration and Production. Oil prices have softened, but major projects in West Africa are continuing. For example, Gabon has 300 days of drilling for a five-well program in progress. Ivory Coast is getting an FPSO, and due to the PSC agreement, low oil prices don’t have as big an impact. Overall, West Africa is heating up, with little regard for oil prices. Most banks have pulled back on lending to Africa, but sources still exist. The Norwegian bond market is still good. The ESG strings on a number of loans are still being pulled.

Small Cap OFS. The 2nd half of the year should be down in the U.S. in terms of activity. A solidly consensus view. What happens over the next 6 to 9 months is impossible to predict. The cost side of the business has been more on the service side instead of the asset side. A great opportunity to upgrade people and equipment. Best places to play. Grow a third of your business in more industrial end markets. Has work gotten more or less competitive? Market share gains in the most unconsolidated sectors are a very positive situation. We will drop prices to avoid bankruptcy, but that is not an issue right now. Repurchasing our own shares has been a great deal, and less shale inventory is good for workover rig companies like Key, Ranger and Clearwell. The Permian will still be the hot business district for the industry.

PPHB U.S. Energy Market Highlights:

Commodity Prices: WTI crude oil is currently $60.94 per barrel (down ~0.4% week-over-week) and natural gas is $3.52 per MMBtu (down ~3.2% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.4 MM BOPD (up ~2.3% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories decreased by ~2.8 million barrels week-over-week vs. an estimated increase of ~1.0 million barrels.

Frac Spread Count: There are currently 193 frac spreads operating in the U.S. (a decrease of 7 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 553 drilling rigs operating in the U.S. (a decrease of 10 rigs week-over-week).

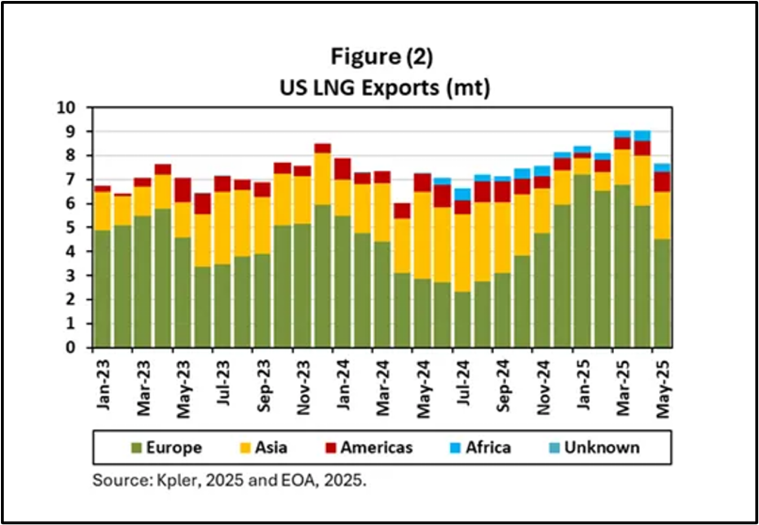

Does LNG Matter? The answer has to be yes, since a small drop in LNG throughput at one facility, the Freeport LNG train, has dropped natural gas prices by 6% lately. Back in 2022, the facility had a fire that damaged some tanks, and it took some time to get FERC’s approval to restart operations. Then, their huge electrical power needs caused outages. Earlier this month, a compression station went out. And now, because the throughput is down, even though the company has made no public statements, the perceived reduction in demand for the 2.2Bcf/d facility has caused natural gas prices to lose about $0.20 per Mcf or ~6%. It seems like a more fragile market than assumed. Notice the trends and seasonality of LNG below.

LNG: America’s Energy Future. A court just stopped the tariffs, throwing many businesses into question, including the viability of new LNG capacity. The Russian-Ukraine war changed the landscape. And the back-and-forth discussion of a settlement has caused increased volatility in natural gas prices. Europe will keep growing LNG imports while China buys it from elsewhere. Europe used to get about 28% of natural gas from Russia and now it is only about 3%. Europe doesn’t want to go back to Russian gas since it has now been used as a weapon. There are several FIDs scheduled for this year and next year, and there is pent up demand from both equity investors and banks, so the financing of LNG expansion will not be an issue. All contractual supplies have a 30-day cancellation, but 90% of TX and LA gas is contracted and will flow. The remaining 10% can play spot, or the LNG isn’t produced, and gas isn’t taken, resulting in increased short-term volatility.

Not In the News. Four Palestinians were killed by Hamas in Gaza on Wednesday as hundreds of people stormed a warehouse to access food aid. The news comes as the World Food Program warns that 2 million people are at risk of extreme hunger amid international pressure over a new U.S.-backed aid distribution process. But members of Hamas wanted the food aid for themselves and not the people of Gaza. So, they shot and killed four as the remainder fled the scene. Bad guys.

Dangerous Business. Three workers died in an accident on a Chevron deepwater platform, 60 miles offshore Angola. The fire injured another 17 people, some seriously. A return-to-service date for the platform has not been disclosed.

Trading Places. We have been keeping up with Texas becoming a stock exchange hub. The New York Stock Exchange probably has little to worry about, but we will see. First, the Texas Stock Exchange, an all-electronic exchange, announces its opening, backed by some financial giants. Then the NYSE announces it is moving the Chicago exchange to Dallas. The goal of both is similar, to provide an exchange more dedicated to smaller, regional companies, but one of the first to list, with a dual listing on the NYSE, is Halliburton. Again, leading the way.

The Future?? President Trump issued a new initiative, ordering the Reform of the Nuclear Regulatory Commission. According to ChatGPT:

This presidential report emphasizes the importance of abundant energy for national and economic security, arguing that nuclear energy can reduce America's dependence on foreign rivals. It highlights that while the U.S. once authorized the construction of numerous nuclear reactors, regulatory approval has significantly stalled since 1978, with only two new reactors becoming operational. The Nuclear Regulatory Commission (NRC) has implemented lengthy and costly licensing processes that hamper nuclear power development, despite advancements in technology promising safer and more efficient nuclear energy.

The report criticizes the NRC for its overly cautious approach to safety, suggesting that it prioritizes mitigating remote risks without considering the substantial domestic and geopolitical costs of such risk aversion. The NRC’s safety models, which assert that any exposure to radiation is harmful, are described as scientifically unsound. This perspective leads to irrational demands for nuclear plants to meet safety standards that are lower than naturally occurring radiation levels. The report argues that a narrow focus on minimizing trivial risks overlooks the risks associated with alternative energy sources, including pollution and health impacts.

The overall thrust of the report is a call for a reevaluation of nuclear energy policy to promote its development, enhance energy security and capitalize on technological advancements, asserting that a balanced approach to energy production risks is essential for the nation's future.

The Oilfield 360 Podcast: This time I was with my good friend and co-host David de Roode interviewing Lucas Gjovig, CEO of GO Wireline, headquartered in North Dakota. Fascinating guy and podcast. Links below:

Vacation!!!! I will be on my annual Bike and Barge Extravaganza, this time in Italy, for the next week so I will not be writing (or focusing!) on business.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.