October 31, 2025

Things I Learned This Week at Home in Tennessee

I ended last week playing on the beach in Pensacola with friends and eating some great seafood. In answer to my last week’s question, I think I am a live at the beach, visit the mountains kind of guy. Burying your feet in the sands while listening to the waves break, smoking a good Cuban cigar and sipping on a Cuba Libre. I could not leave on Sunday. I just couldn’t go. My friends forced me out on Monday so I came home. Something about shrimp getting increasingly ripe over time. Me? But my feet got itchy and Tennessee called. While I went to High School in Memphis, many people left and migrated east, closer to Nashville. Our high school reunion weekend, in a suburb of Franklin, was a raving success. Central Tennessee is a particularly nice place to live and grow up. But to come completely clean, I am writing this in New Orleans where the responsibility fell on me to spend Halloween taking on Bourbon Street. Wish me luck.

Conference Calls. Earnings continue to come out. Most companies are hitting guidance, but then they have been guiding the street down all year. The outlook focused on what the companies were going to do in the market, rather than talking about how good the market might be. Optimism still exists, but it feels like we have been promised something for a long time now and we still do seem to get rewarded. The world looks flat, with the OFS sector bumping along the bottom, hoping for light at the end of the tunnel. E&P isn’t happy, but they just hunker down and protect their value since there isn’t enough cash flow to get stupid, and CEOs and board members know better now. Midstream is in the catbird seat, and most of their issues are 1st world issues since natural gas production is set to increase by 30%+ over the next five years. No sector has that kind of visibility. No one is sure what the price will be, but the volumes will be up. All of that is about oil and gas, but we have an even bigger issue.

Electricity. It is now all that matters. If you aren’t telling me what you are doing to boost electricity availability, I have no interest in your story. We are just part of a 3-dimensional org chart with electricity in the center. Oil and natural gas, wind, solar, geothermal and hydro all generate electricity. That electricity runs everything in our lives. We need to understand that and realize we aren’t the center of attention anymore, but we are a critical part of the supply chain to produce electricity.

Casual Day. While I ended last week in Tennessee, this week I headed to New Orleans for a quick line in the water. While at Love Field waiting for my flight, I noticed something. No one was boarding the plane and flying to New Orleans wearing a suit, tie, or even a sport coat. Not one “business traveler”. Odd I thought, but it’s New Orleans after all. So, I went to the next gate where a plane destined for Houston was beginning to queue up to board. One sport coat. That was it. Not even socks and a nice shirt or anyone else. I had to ask the sport coat what he did for a living. An attorney. Of course. But the only one on a Thursday morning flight to Houston? Times appear to have changed in many ways.

This is a Transition. Remember the Williams Companies, symbol WMB? They were a pipeline construction company originally, with a somewhat checkered past of performance and management. In 2016, six board members resigned after shareholders refused to fire the company’s CEO and cancelled a $33 billion merger with Energy Transfer, dropping the stock price by 70% in nine months. But then Williams decided to shift its business. Today, the stock is back to 2014-2016 levels, one of very few energy stocks that can make that claim. And they did it by moving the company in a different direction. Instead of building pipelines and other infrastructure, which had been a boom-and-bust business for decades, the company is moving into LNG and Power, two of the most attractive segments of the energy markets today. The company is investing $3.1 billion to enhance its power generation capacity, bringing the total of what the company is spending on its power projects to $5 billion, a big bite for a $70 billion market cap company entering a new market. This is on top of the $1.9 billion the company will invest in a 10% interest in the Driftwood Pipeline and Woodside’s Louisiana LNG project. To quote the company “These transactions reinforce Williams Companies’ ambition to expand its integrated natural gas infrastructure footprint amid accelerating U.S. and global LNG demand and highlight its continued emphasis on pipeline and export connectivity”. These transactions mark an important step forward in Williams’ wellhead to water strategy—integrating upstream, midstream, marketing and LNG capabilities to deliver the cleanest, most reliable energy to global markets,” said Chad Zamarin, President and CEO of Williams. The stock is up 4x from its 2020 low. That is a successful transition.

Sums It Up. An OFS CFO made a very good point in the conference call that blankets the sentiment of executives in the sector. "With recent oil price volatility, we expect continued challenging conditions in the oilfield services market over the near term". He emphasized a continued focus on cost control, prudent capital allocation, and strategic growth in less capital-intensive service lines. Amen.

PPHB U.S. Energy Market Highlights:

Commodity Prices: WTI crude oil is currently $60.57 per barrel (down ~1.5% week-over-week) and natural gas is $4.21 per MMBtu (down ~1.6% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.6 MM BOPD (up ~1.1% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories decreased by ~6.8 million barrels week-over-week vs. an estimated increase of ~2.9 million barrels.

Frac Spread Count: There are currently 178 frac spreads operating in the U.S. (an increase of 3 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 527 drilling rigs operating in the U.S. (a decrease of 1 rig week-over-week).

The Next Deal. From Wood Mackenzie: “Obviously not everybody has the balance sheet, but we think Exxon and Chevron do. We think that EOG could make a deal, but by-and-large more consolidation, especially if we do see some price weakness. And I just don’t think there’s any reason to [believe] that the wave of consolidation is done in the Permian” says Nathan Nemeth, principal analyst for Canadian and Lower 48 unconventional plays.

Uh Oh. OpenAI has more than 100 ex-investment bankers helping train its artificial intelligence on how to build financial models as it looks to replace the hours of grunt work performed by junior bankers across the industry. OMG. First, where do you find 100 ex-investment bankers? Then again, the money is flying around like crazy (I am an ex-investment banker and I would be happy to help OpenAI. Feel free to give me a call). So, who is going to be the cannon fodder that works 15 hours a day, 6-7 days a week? How can you yell at and generally abuse an AI program? It’s bad enough that so many investment bankers have never done anything but looked at a P&L and never ran one. Now the grunt work education goes away. It makes you wonder what it will take to be a successful investment banker in the future.

Win-Lose. In 2023, the Teamsters union cut a deal with UPS. It raised the average compensation for full-time UPS drivers to $170,000 from $145,000 over the past five years, or $80 an hour. They also get up to seven weeks of vacation and don’t have to pay healthcare premiums. As you might expect, the problem is economics. UPS is now cutting 48,000 jobs in an effort to cut costs. White collar jobs. The union job protection efforts are being dumped as people, union and not, losing their freedoms.

And More. Amazon is cutting about 30,000 corporate job as the company works to pare expenses and compensate for over-hiring during the peak demand of the pandemic. Amazon does have 1.55 million employees so the percentage isn’t huge, but it is on top of the 27,000 cut implemented about two years ago.

Gone Under. I used to play Petrofac regularly in my hedge fund days. Now, they are going away. Well, no company actually goes away from bankruptcy these days. The capital structure is just rearranged. But Petrofac is not a U.S. company, its a UK company. When a company “enters administration”, management goes away. Wow. Both U.S. bankruptcy and UK administration are very similar, but differ in control, process and objective. In the U.S., a company's existing management typically remains in control while reorganizing, whereas in the UK, an independent administrator takes over all management duties. Petrofac has been in business for more than four decades and it designs, builds, manages and maintains oil, gas, refining, petrochemicals and new energy infrastructure, deploying their expertise and experience to deliver world-class energy facilities that are engineered for safety and operational efficiency.

Company Reviews - Analysts View

NOV

“It was a quality quarter for NOV, as results came in modestly better than expected, thanks to a strong EE result in capital equipment that offset weakness elsewhere. Near-term results will continue to be impacted by weaker activity levels around the globe with whatever oil-price related impacts may come over the next few quarters. Thankfully, NOV is well-positioned with a strong balance sheet, solid FCF generation, and a cycle record 3Q25-ending backlog to weather the storm until a late 2026/early 2027 anticipated improvement. CEO Clay Williams laid out a scenario where the company could be firing on most cylinders to break out of the ~$1 billion EBITDA range, with offshore (deepwater) and international unconventional development taking over the lead role from U.S. shale. This remains more of a 2027 story, the visibility of which should unfold over the coming months. Next few quarters and coming months makes me think it is too early to buy this and other OFS stocks right now. It might be the bottom but we can stay awhile”.

Baker Hughes

“BKR's stock was down 3% on Friday despite what we considered to be strong results. We think this reflected disappointment as a strategy update was not provided, although we sense that a portfolio review is under-way with management likely to provide their conclusion by mid-2026. Regarding fundamentals, the IET segment continues to beat on both revenues and margins. That said, in 2026 we think margin expansion will be the driver of segment EBITDA as top line growth slows. BKR also showcased an ability to expand sales within the power generation vertical with a 1GW (~$500mm) sale of larger aeroderivative turbines for oilfield applications”.

Headlines.

This year, BP has made 11 exploration discoveries across several basins, including in the Gulf of America and in Brazil’s Santos Basin.

Transocean outlines $3.8B–$3.95B contract drilling revenue target for 2026 as debt reduction accelerates.

Shell posts $5.4 billion third-quarter earnings, topping forecasts.

The Pitch For the Deal. “The global push to net zero isn’t slowing down”. That was the opening line of the email. Blue Green Energy is in the process of developing California’s first fully integrated green hydrogen company — one that can produce, retail and distribute clean hydrogen fuel within the state. What a deal. We discuss hydrogen transportation and handling issues elsewhere in the note, but this is more about that stockbroker somewhere, cold calling nameless faces, to get them to play. “You can own shares at $2.50 each through our SEC-qualified crowdfunding offering. Once this round closes, the price doubles to $5.00. With a $25.00 IPO target, early investors have a clear path to a 10x potential upside”. Is this too good to be true? “The close – Over 140 countries have committed to carbon neutrality. The U.S., EU and nearly every major automaker are on timelines to phase out fossil fuels entirely. Trillions are being committed to clean energy — this transition isn’t optional, it’s happening”. A $2.50 hotbox of words. Geez.

Hydrogen Gets Hotter. Fuel cells have been around for a long time. I have a headline that says hydrogen is going to overtake gasoline and be the transportation fuel of the future. The headline was 23 years ago. Hydrogen was dropped out of the EPA’s power plant credit rule because the technology and infrastructure for hydrogen was not developed enough that the government thought they could get sued for mandating/incentivizing use of hydrogen. Hydrogen embrittlement occurs when regular steel pipes, valves and bolts come into contact with hydrogen, deteriorating the integrity of the steel. All new pipes, meters, valves and more will have to be developed and built using a higher metallurgy, which is a major obstacle. Enter data centers, and the world changed.

Who Plays? There are a couple of companies that were once high-fliers, but the disappointment in fuel cell adoption lasted years and caused them to crumble.

Ballard Power Systems now has a $1 billion market cap and is trading sub $4 after hitting $38 four years ago. It went public in 1996 and hit a $53 billion market cap in 2000. The stock price has doubled this year.

Plug Power now has a $3 billion market cap and is trading sub $3 after hitting $65 four years ago. It went public in 1999 and hit a $150 billion market cap in 2000 and is up 24% this year.

Enter Bloom Energy. Up 400% this year, the company went public in 2018, eighteen years after the valuation peak of the other fuel cell companies. A $30 billion valuation makes them the 900 pound gorilla of fuel cells. Solid oxide fuel cells, a Bloom technology, is seen as a possible new source of power for the surging energy demand caused by the expansion of AI data centers. Bloom's fuel cells operate independently of traditional power grids.

Behind the grid. Exactly what the data centers need. A huge distribution hub for hydrogen? I’ll take the under on that bet. But a dedicated set of fixed location fuel cells can make a great deal of sense, and Bloom seems to be outpacing its peers. So far, they have 1.5 gigawatts of power, with 300 megawatts dedicated to data centers and that is the segment that is driving expected growth and current valuation. While a fuel cell may not take over the world any time soon, large, fixed cells seem to be the future for data centers who require reliable power and generation, especially when the “waste” that is generated consists of water and heat. So far this year, the company signed major power provision contracts with Brookfield, one of the owners of Westinghouse Electric, Oracle, and Equinix.

From NOVUS – The Bridge. Emily Easley has been featured several times here and she is still at it. The latest -

From Shutdowns to Shovels: Power Gets Real

While Washington debated another shutdown, I flew to Houston where 2026 budgets and build plans are already rolling. The talk wasn’t about politics. It was about power: turbines, transformers, pipelines and offtake agreements.

Back in D.C., the Department of Energy quietly dropped a bombshell - invoking 403 and directing FERC to open the wholesale market for large electric loads like data centers and industrial users. It’s a big deal. Think PURPA all over again, but this time, independents are on the demand side.

Deregulation isn’t just a Texas thing anymore. It’s becoming America’s next energy business model. The energy business has entered its next cycle. It is less about subsidies and sentiment and more about contracts and current. And while policy scrambles to keep up, the people who understand both regulation and real estate are already shaping what comes next.

Energy is moving from what’s promised to what’s being poured. The real question isn’t what’s next, but what actually scales.

Nuked. Westinghouse Electric, Cameco and Brookfield Asset Management and the U.S. government have entered into a strategic partnership to accelerate the deployment of nuclear power, in accordance with the President’s May 23, 2025 executive orders. First, a little background. Westinghouse Electric is owned by Cameco (49%) and Brookfield (51%), having acquired the company in 2023. Westinghouse is a recognized global leader in nuclear energy with its technology serving more than half of the world’s operating nuclear power fleet and has the only SMR currently in operation, the AP1000, a pressurized light water reactor. It also has designs in approval for the AP300, a scaled-down version about the size of most buildings along the road from Midland to Odessa. There are six AP1000 reactors currently running with 14 additional reactors under construction and five more under contract. The AP1000 technology has been selected for nuclear energy programs in Poland, Ukraine and Bulgaria. The agreement with the U.S. is to build $80 billion of AP1000s and AP300s, which according to the press release, “… the new reactors will reinvigorate the nuclear power industrial base.” And it will. Both Biden and Trump have reduced approval schedules, with Trump issuing an EO on it and stating that we must beat China and Russia to the moon by putting an SMR on the moon by 2030. The nuclear industry is not at all dependent on the government’s assistance but on its willingness to stay out of the way. The demand for power from the industrial and technology segments will continue with industry more than happy to fund incremental power directly or indirectly. With zero emissions, technology companies are likely to be more willing owners of nuclear power generation than the emissions generated in the years of using natural gas until SMR approvals come. The business is staged to grow dramatically with the SMRs providing smaller scale modular construction for efficient build schedules and state-of-the-art safety and reliability. In addition, each two-unit Westinghouse AP1000 project creates or sustains 45,000 manufacturing and engineering jobs in 43 states, and a national deployment will create more than 100,000 construction jobs.

Government Commentary:

Howard Lutnick, Secretary for the United States Department of Commerce

“Our administration is focused on ensuring the rapid development, deployment, and use of advanced nuclear technologies. Together with Westinghouse we will unleash American energy.”

Chris Wright, Secretary for the United States Department of Energy

“This historic partnership with America’s leading nuclear company will help unleash President Trump’s grand vision to fully energize America and win the global AI race. President Trump promised a renaissance of nuclear power, and now he is delivering.”

Connor Teskey, President of Brookfield Asset Management

“This partnership with the government will help unlock the potential that Westinghouse and nuclear energy can play to accelerate the growth of artificial intelligence in the U.S., while meeting growing electricity demand and energy security needs at scale. Brookfield has more than half a trillion dollars invested in the critical infrastructure that underpins the U.S. economy, and we expect to double that investment in the next decade as we deliver on building the infrastructure backbone of artificial intelligence.”

Major Leak. Everyone has been looking at the E&P assets that are falling out of the wave of consolidation transactions over the past couple of years. It has been more of a trickle than hoped, and with oil prices where they are, deals have been hard to come by. But other assets work. Chevron is putting its DJ Basin gathering system on the blocks. Acquired in the 2020 Noble acquisition, the deal includes the 500,000 b/d of crude gathering pipes in the DJ as well as several other lines and a small natural gas gathering system, which together are expected to fetch a price tag approaching $2 billion, based on the expectation that it would generate $200 million in annual earnings. Midstream still looks attractive.

Two Tracks. There are two very obvious tracks for natural gas. It will be the primary fuel to power data centers for at least the next seven years. It is plentiful (Jerry Jones says there is $100 billion of value in the Western Haynesville) and relatively cheap. One track will be electricity powered away from the grid, dedicated to data centers and possibly selling any excess power, it there is any, to areas negatively impacted by the effort. The other track is the conventional baseline power natural gas has long provided after taking a significant share of the market away from the coal industry. Below is a summary of the current IEA Gas 2025 Report.

Record LNG Investment in 2025

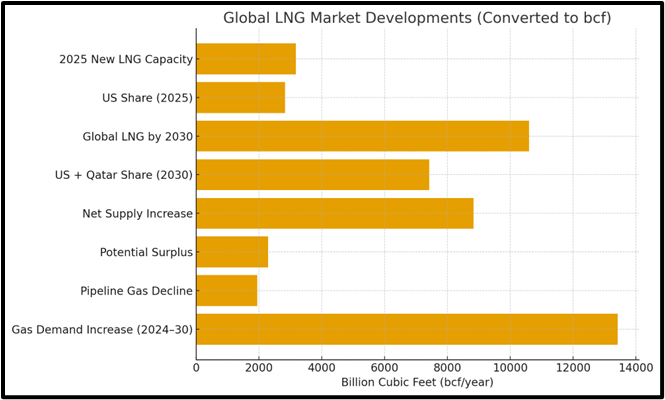

Despite lingering macroeconomic uncertainties, 2025 has seen the second-highest amount of LNG liquefaction capacity reaching final investment decision (FID) in a single year.

Of the 3.2 billion cubic feet per year of new liquefied natural gas (LNG) capacity that has been approved in 2025, the U.S. will make up 2.8 Bcf, a record-breaking number.

The U.S. is currently capable of producing more than 8 Bcf per day, driven by projects such as Louisiana LNG, Corpus Christi (Trains 8–9), CP2 Phase 1, Rio Grande (Trains 4–5) and Port Arthur Phase 2.

This reflects strong investor confidence and a supportive U.S. policy environment for natural gas.

U.S. and Qatar Dominate Global Expansion

By 2030, the U.S. could supply around one-third of global LNG, up from 20% in 2024.

The U.S. and Qatar together will deliver roughly 7,416 Bcf per year of the total 10,594 Bcf per year of new global capacity expected by 2030.

The U.S. and Qatar together will represent about 70% of the nearly 21 Bcf per day of new global LNG capacity expected by 2030.

These projects will add a net 8,829 Bcf per year of global LNG supply, even after accounting for declines from older producers. This is equivalent to 7% of Asia’s thermal coal demand.

Market Balance and Demand Outlook

Global natural gas demand is projected to grow by 1.5% annually from 2024 to 2030, or about 10,594 Bcf per year, with the Asia-Pacific region accounting for 80% of this growth.

However, supply growth is expected to outpace demand, potentially leading to an LNG surplus of approximately ~2,296 Bcf per year by 2030.

Pipeline gas trade is forecast to decline by roughly 1,942 Bcf per year over the same period, mainly due to lower European imports.

In contrast, long-distance pipeline gas trade is projected to decline by nearly 55 Bcf per year.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.