July 18, 2025

Things I Learned This Week at Home with Henry

Disruption. It isn’t always a bad thing, and, in my case, it is very well worth it! Henry, my rising senior at University of Colorado, is home for the summer. I expected him to eat me out of house and home, and he has not disappointed. He’s cutting back from six eggs for breakfast so there is hope for my budget. I just go to the grocery store a great deal more often than before he came home. And why is it that some people seem to be completely unable to shut a cabinet, drawer or pick up a glass? Oh well. So, the bachelor pad now has two residents, and less action than a library on a Saturday night! I am having a great summer and will start haunting Houston more often after he goes back.

Optimism. Activity continues to edge down. Production is expected to peak any day now; however, production is still up, even with a falling rig count. The idea of $100 oil has faded away from all but the most extreme observers. Bottom? Soon? So, earnings reports are starting. The sector learned many years ago about the virtue of helping analysts get their current quarter predictions right. It’s that pesky future that is the problem. I can guide for three months through the current quarter, knowing how the results are trending. But the future is anyone’s guess! As a result, we don’t expect any large misses, just a continued guide down. One point we made at the beginning of the slowdown… No analyst has ever lowered estimates just ONCE in a downcycle. Ever. And in keeping with that axiom, and the direction of activity, estimates are likely to continue to erode, making it very difficult for investors to look at the sector. We are already well into summer, and conferences will be back-to-back. But from what we are hearing, there might not be any new faces just yet. Once we find our baseline level of activity, the uncertainty eases, and planning is possible. The goal is to still be alive when we get there.

PPHB U.S. Energy Market Highlights:

Commodity Prices: WTI crude oil is currently $65.19 per barrel (down ~0.3% week-over-week) and natural gas is $3.59 per MMBtu (up ~6.5% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.4 MM BOPD (up ~0.6% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories decreased by ~3.8 million barrels week-over-week vs. an estimated decrease of ~1.8 million barrels.

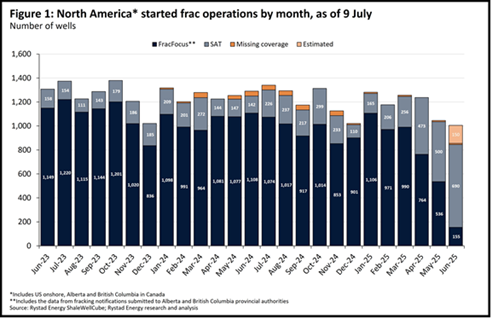

Frac Spread Count: There are currently 180 frac spreads operating in the U.S. (an increase of 4 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 522 drilling rigs operating in the U.S. (a decrease of 2 rigs week-over-week).

Relevant Statistics.

Texas, the top-producing state, saw its crude oil output rise 1.8% to 5.8 million barrels per day in April, the highest level since November.

The Lower 48, which excludes offshore production, produces 11.2 million barrels per day, but up only 10,000 barrels per day from the previous month.

Oil demand increased by 263,000 barrels month-over-month in the U.S. to 20.2 million barrels per day in April.

Gasoline demand in the U.S. rose 145,000 barrels per day to 8.9 million barrels per day in April, the highest since October last year.

Demand for distillate fuels, which includes diesel and heating oil, edged lower marginally to 3.88 million barrels per day in April, from 3.89 million barrels per day in March.

Soap Box. New research this week said that shoppers are shunning items over plastic packaging. It struck a note. A couple of years in a row, I went fly fishing off the southern coast of Mexico on the Gulf side. The amount of plastic trash and plastic bags that filled the mangroves was just stunning. I came back and immediately became a member of the plastic alliance. I was just telling my son the other day, while we were shopping, to only buy eggs in paper cartons and not to buy the eggs in plastic and expanded polystyrene foam, also known as Styrofoam. This all comes from a research study by a sustainability consulting firm. The consultants found that 37% of consumers surveyed had decided against buying something because it was unsustainably packaged. Have you ever seen a banana for sale at the airport, sitting on a Styrofoam plate and wrapped in plastic? There was a push in corporate America to reduce the amount of plastic, but companies like Coca-Cola and Unilever are now easing those initiatives. Wrong decision in my humble opinion. Little things add up. Look and see how quickly your garbage can fills up every week and look at what takes up most of the space. The heck with calories. Let’s start paying attention to packaging.

Sure Took Long Enough. In April 2024, SLB announced it was going to acquire ChampionX, subject to the usual issues. It wasn’t supposed to take so long. The U.S. authorities approved the deal almost right away, in mid-May 2024. But the Australian, British and Norwegian approvals only came this past week! The Australians were focused on the “horizontal overlap” between SLB and ChampionX’s supply of sucker rod pumps in Australia. Britain and Norway were more concerned with their drilling business overlap, but they approved this week as well. So, the deal is now completed, and, after only 15 months, the $7.8 billion deal closed.

Girl’s Best Friend. Cheaper. The sale of U.S. Synthetic Corp by ChampionX was required for the combination with SLB. U.S. Synthetic has a huge market share in the industry for synthetic diamonds and inserts for drilling. It’s a great business with little growth, but huge margins. So, I thought it was interesting when I read an article about De Beers, the diamond company. We all remember the days of cubic zirconia stones and the beginning of lab-grown diamonds, but it appears to have now gone mainstream. Cubic zirconia (CZ) and lab-grown diamonds are distinct materials with different properties, despite both being created in a lab. Lab-grown diamonds are chemically identical to natural diamonds, while CZ is a diamond simulant made of zirconium dioxide. Lab diamonds have the same brilliance, fire and scintillation as natural diamonds, with a natural-looking sparkle. You can buy a perfect one-carat, lab-grown diamond for a fraction of what a natural diamond would cost. And they’re both diamonds. I read last week that there is a company that will take the ashes of you or your loved one and have them made into a diamond so you can have that loved one around your neck or on your finger and never say goodbye. It is now being pitched that grown diamonds are for fashion jewelry and natural diamonds are for high-end jewelry. It’s like saying my barrel of oil is better than your barrel of oil, but all of their characteristics are identical. Maybe. But they’re both just barrels of oil. Or in this case, diamonds.

Copper Rush. We mentioned it last week and it is still at the top of people's minds. Copper. Between tariffs and the huge demand for everything associated with electricity, demand for copper is expected to move up steadily over the next many years. But the industry had been somewhat complacent. There are a couple of new mines opening up and expansions of existing ones, but there hasn’t been a land rush of building new facilities in years, and that appears on track to change. S&P Global did a study that shows that the average mine development times by country have the U.S. at 29 years, Canada at 27 years, and Russia at 16 years. And that’s considered short. Now we are seeing that speed up dramatically. “If all goes as planned, Ivanhoe Electric will begin construction of the Santa Cruz mine early next year and start selling copper cathode to manufacturers before the end of 2028.” The implications of that are dramatic. Last week we made some jokes about Colorado when we mentioned copper. And we will do it again this week. We’ve had a slide in our deck for some time showing a compromised pit in Colorado, wondering when it was gonna be reopened. It’s looking less and less like a joke.

Consolidation Effects. “30 E&Ps represent 65% of all spending to drill, complete and produce oil and gas wells in the U.S. on land. Of the 30, 7 are private.” – Richard Spears.

Core Changes. The U.S. longshoremen have threatened to strike unless management teams guarantee NOT to automate their jobs. It won’t happen. Actors and writers are trying to salvage their livelihoods from the AI threat. Thousands of programmers were let go since all the big tech companies realized AI models can program faster and more efficiently. When cities on the West Coast increased the minimum wage too high, fast food places replaced employees with computerized kiosks, and others closed. There are now robotic, self-driving taxis operating in several cities. Now, construction equipment is being automated too. Bedrock Robotics is a company that modifies existing equipment with cameras, LIDAR, computers and AI software that enables them to work around the clock, including in blistering heat, when human workers would need regular breaks. They are starting with excavators. This represents the basic laws of economics and also serves as some foreshadowing.

Deadbeat. We have recently listed the companies owed money by the Mexican national oil company, Pemex. It is getting more serious. The Energy Workforce & Technology Council (EWTC), which represents more than 250 energy service companies, has formally called on Mexican President, Claudia Sheinbaum, to address outstanding payments owed by Pemex to oilfield service providers. Its member companies collectively account for more than 60% of Pemex’s contracted oilfield services work. The work totaled over $1.8 billion for just 2024 and 2025 so far. According to the letter, Pemex owes EWTC companies an estimated $871 million for services rendered in 2024 and $983 million is owed for work completed in 2025, including unpaid and unbilled services. Furthermore, $2.5 billion in contracted work is scheduled for 2026. EWTC and its members are seeking high-level dialogue to resolve these matters collaboratively and ensure the long-term health of Mexico’s oil and gas sector. We can’t work for people for free.

Christmas is Coming! “Self Nose Piercing Kit Nose Piercing Gun Kit Tool (White).” $3.98 on Amazon.

Innocuous Headline. Exxon is swapping some oil out of the SPR for its refinery in Baton Rouge, Louisiana. The DOE authorized the action “to help maintain a stable regional supply of transportation fuels across Louisiana and the broader Gulf Coast.” Yawn. I’m not an in-depth refinery guy, but I try and keep up, and this report didn’t strike a chord. At first. It seems there is too much zinc in crude oil production coming from the offshore Mars production system. Quality problems with crude oil. Too much zinc? Never heard of it. But it was enough that Exxon warned suppliers of “serious quality issues” related to the high levels of zinc and would quit accepting oil from the Mars pipeline, "in an effort to avoid further damages.” Mars delivers 600,000 barrels per day to Gulf Coast refiners. The culprit has been identified. Chevron’s new Ballymore deepwater field has a start-up well that is causing the zinc contamination. The issue is the potential damage to refining equipment and catalytic converters. It causes the oil to become acidic, increasing wear on cams, bearings and bushings. From the beneficial side, zinc was added to crude oil as an effective anti-wear additive that helps protect engine components and was primarily used in older muscle cars. Chevron said that they have identified the issue and production guidance will not be changed. But if Exxon warns people not to buy your crude, it has some impact somewhere.

This is Non-Partisan

There is a Transition. People talk about the “energy transition” and they miss the point. Our industry has been getting cleaner every year for decades. That's nothing new. But the entire business world is transitioning. All of a sudden, the world changed in ways we didn't expect. It's easy to say we're going to put our data into an AI model and change our world. And how does that data go into the AI model? The data has to be organized in a way that the model can understand, calculate and compare to other metrics in the system. That means every record and every file of every company has to be checked, verified and formatted before the AI models can possibly be optimized.

Everything for Best Results. We've already seen what happened with a couple of these LLMs, where garbage in produces garbage out. If I'm a $100 billion company and I'm going to fully optimize the potential of AI, I need to properly clean my data. Well records, production records, seismic records, logs, every variable in an income statement, a balance sheet and a cash flow statement and everything having to do with inventory, billing and collections. In our current structure, all of those functions are at the bottom of an inverted tree, and at the top of the inverted tree, at the trunk, is the CEO, with all the branches and limbs. The functions of the limbs and stems depend on the industry, but the structure is the same.

Change is Coming. The easiest way to think about a typical organization is as an inverted tree. Different channels of information feed up from the bottom, through layers of management, up to the CEO at the trunk. AI will change this. The model will have access to every piece of information that can possibly affect whatever it is being asked to do. Information won’t be in silos, moving up the chain, but immediately available. It has to be able to touch the farthest reaches of the branches in order to give the most accurate and correct outcome, whatever that outcome might be. But all historical data must be loaded in to allow for the most accurate calculations and conclusions. It's a monumental task. All of a company’s data must be found, cataloged, formatted and verified.

Benefit. The good part is that you only have to do it once. All historical data is loaded into the model and future uploads can be automated to make everything easier. So, a big summer job? Cleaning up data. Ask around what interns are doing this summer in our industry. We used to dread hiring interns because you had to find something for them to do, and whatever you had them do would become a dead project when they left. But now they are going through chunks of data in teams, making sure that everything is organized, verified, formatted in such a way that an AI model can understand the nuance.

The Last 4th of July Meme!!

Power Move. A new report from the Department of Energy (DOE) studied the impact of data centers and AI on the nation’s power demand and grid reliability. The study was designed to examine the implications for grid reliability in 2030 under three power supply scenarios:

Scenario 1: The current planned retirements of operating power plants.

Scenario 2: No retirements of power plants.

Scenario 3: Current planned retirements with a replacement program to restore the grid to its current operating reliability standard.

The DOE report concluded that blackouts could increase by 100 times by 2030 if planned power plant closures remain on schedule without adding new units to replace them. The DOE said, “Staying on the present course would undermine U.S. economic growth, national security and leadership in emerging technologies. None of these outcomes are acceptable.” Thanks, Allen Brooks.

Long Time. The U.S. working rig count has fallen to the lowest for 46 months since September 2021 as the industry scales back drilling in response to reduced prices. The number of active rigs has averaged just 423 so far in July, down from 486 in March, and 479 in the same month a year ago.

Welcome to CA! PG&E’s average rates have climbed 56% in three years and 118% over the last decade. The California Public Utilities Commission has approved four rate increases for the utility this year alone. Because rates are progressive, heavy power consumers pay higher marginal rates.

One Opinion. J.P. Morgan’s U.S. equity research analysts compiled their list of “most compelling structural and tactical short ideas” for the second half of the year. Within energy:

Canadian Solar: “There are risks of continued overcapacity and depressed pricing… CSIQ will likely need to sell stakes in recently added U.S.-based manufacturing given new restrictions included in the One Big Beautiful Bill.”

ChargePoint: “EV charging hardware growth likely to remain challenged amid weaker EV growth and elevated interest rates.”

Nabors Industries: “Above-average debt burden, while FCF/EV remains relatively in line with peers, leaving the equity disadvantaged.”

Vital Energy: “Limited FCF generation in 2026+ paired with high debt/leverage and a short inventory life relative to peers.”

What Prices?? “For E&Ps, stocks are implying $61.59 per barrel (WTI) and $3.48 per a thousand cubic feet (HH) and trade with an FCF/EV yield of 7%/8% in ‘25/’26.” - Julian Triscott, Energy, Utilities & Clean Tech Desk Sector Strategist, RBC Capital Markets.

Higher Demand. OPEC launched its World Oil Outlook 2050 yesterday during the OPEC Seminar 2025. OPEC predicts global oil demand will rise by 9.6 million barrels per day to 113.3 by 2030 and by 19.2 million barrels per day to 123 by 2050. Most growth will come from road transportation (+5.3 million barrels per day), jet fuel (+4.2 million barrels per day) and petrochemicals (+4.7 million barrels per day).

Kick the Can. First, the backstory. The original settlement agreement in August 2023 between the Biden administration and environmental groups (including the NRDC and Earthjustice) was aimed at protecting the Rice's whale. The agreement had provisions for excluding Rice's whale habitat from future oil and gas lease sales and implementing vessel speed restrictions in their habitat to reduce ship strikes. It would have closed a great deal of the Gulf to current production operations. But we kick cans well. The initial settlement agreements stipulated a time frame for NMFS to propose and finalize critical habitat for the species.

In October 2022, the parties submitted a Stipulation to Modify the Stipulated Settlement Agreement (“First Stipulation to Modify”). The parties agreed in the first Stipulation to Modify that NMFS would submit the report, no later than July 15, 2023.

In April 2024, the second Stipulation to Modify the Stipulated Settlement Agreement was made.

In August 2024, the parties submitted the third Stipulation to Modify the Stipulated Settlement Agreement agreed to a deadline no later than December 2, 2024.

In November 2024, the parties submitted the fourth Stipulation to Modify the Stipulated Settlement Agreement where it was agreed to extend NMFS’s deadline no later than July 15, 2025.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.