July 25, 2025

Things I Learned This Week Packing for Colorado

Earnings Season is in Full Swing. The stock market is hitting record highs. Energy stocks caught a bid this week, though we admit that we aren’t sure why. The OSX was up over 4% on the day that Halliburton, Weatherford and Baker Hughes reported. Short covering? It is a challenge to buy oilfield services based on the current outlook, even if it is somewhat cloudy and headed in the wrong direction. This is typically when strategic deals start to happen. Our fingers are crossed. It is time to get creative. Our creativity runs toward cooler weather. Many of the big shots have been up in Colorado ever since Texas hit 90 degrees. But as they say, better late than never. So, this weekend, as you read the Weekly, know that I am sweltering in the 70 degrees of heat in Aspen. But we will try and struggle through! We discuss the outlook throughout this piece and how different companies have different strengths and weaknesses. But as we sit here today, there is no shortage of oil in the world. While demand will continue to go up, the ability to supply the growing market has surprised investors for years now. The days are gone where $100 oil could save us.

Finish Line. Chevron completed its $53 billion acquisition of Hess, which has taken more than a year. The sticking point? Guyana. Fabulous Guyana, where Exxon has set all-time records for having the most discoveries offshore without a dry hole. Exxon thought they should get Hess, not Chevron, and I find it hard to blame them. Regardless, the prize is huge. The Federal Trade Commission (FTC) blocked Hess’ CEO, John Hess, from serving on the Chevron board, much the way Scott Sheffield was denied a spot on Exxon’s board as a condition to approve the merger. Now, the current administration has dropped the complaints against Mr. Hess and Mr. Sheffield. Interestingly, Sheffield is saying he is no longer interested in the board position at Exxon. Such drama, but both men were treated completely unfairly by the FTC. Chevron now has a 30% position in the Guyana Stabroek Block, which is estimated to hold 11 billion barrels of oil equivalent that is recoverable. “This accretive transaction is expected to drive significant free cash flow and production growth into the 2030s.” “We are quickly integrating our two companies and expect to achieve $1 billion in annual run-rate cost synergies by the end of 2025. All of this should enable even higher returns to shareholders over the long-term.” – Chevron CFO.

Projection Nuances. Halliburton’s reported earnings missed slightly. Slightly. The “consensus” is what all the analysts publish as estimates for the company. One analyst would enter consensus numbers into his model, which would back cast revenues and expenses. He may be a very accurate analyst, at least from the perspective of being “most consensus.” What a terrible label. A good analyst will always look for ways the consensus might be wrong. 5% to 10% either way can be huge. And brave. Sometimes, I would agree completely with the street’s consensus. I ramble for a reason. One analyst cited a “miss,” with EBITDA being short of the consensus by one percent. The company employs tens of thousands, works in 75+ countries and has a product catalogue not to be believed. Looking at weekly and monthly rig counts and anecdotal stories, it’s no wonder Excel has trouble capturing all the nuances that are reported from the past three months. Revenues were good and margins dropped, which would be expected in a global slowdown. Management warned of a continuing soft period for the near-term. Earnings are rarely cut just once in a down cycle. Halliburton is doing a great job playing the hand they are dealt. As we all know, there is plenty of oil in the world, and the more peace we have, the more oil we will have. No one is expecting any major hikes in oil prices anytime soon, and we know there is downside risk to the current price. So, is this the bottom? No, not according to Halliburton and everyone else. Investors will continue to not care, and Halliburton will continue to be managed, run and operated as the world class, critical industry company that it is. Where does EBITDA go? Who knows! And that’s the point for investors. But as an operating company, Halliburton, and a couple of its peers, are excellent at what they do. It’s more fun in an up-cycle!

Earnings Still Matter. The OFS world is up for Q2 earnings. Halliburton, Weatherford and Baker Hughes have all reported after SLB’s announcement last week. Some did better and some did worse. Halliburton got hurt by its U.S. completions business. As activity falls, so does pricing and margins. SLB did okay last week. HAL reported and gave a very cautious outlook for the remainder of the year. HAL has the greatest exposure to the U.S. completions market, which was great until it wasn’t. International production has issues as well, most notably Saudi Arabia and Mexico are slowing down according to several companies. Weatherford beat slightly and they were optimistic on the call and narrowed guidance rather than just lowering their numbers. Baker Hughes, now more “Energy Services” than “Oilfield Services,” did well. Baker is optimistic because of the expectations of increasing power plant demand and has received over $650 million in data center awards this year and LNG demand is still very high. It is great that some companies have business lines that are doing well right now. But even the best performing energy company cannot generate much buy-side interest from investors. And we all know the reason – uncertainty.

Earnings Details, from a variety of analysts.

PTEN - Patterson-UTI Energy GAAP EPS of -$0.13 missed by $0.09, revenue of $1.22B beat by $10M. Completion services are doing better than we thought. Things are slightly positive as adjusted EBITDA of $231MM and implied guidance of ~$210MM for Q3 are both a hair above published consensus and better than expectations. Net CAPEX is now expected to be less than $600MM, reflecting slightly lower activity.

FTI - Results Beat; Subsea project list grows. Adjusted EBITDA of $509MM beat consensus by +7%, FCF of $261MM was much better than expectations of negative $186MM and subsea orders of nearly $2.6B beat the $2.4B consensus by over 6%. Subsea services are enroute to hit one of the highest quarterly levels ever achieved.

BKR - Orders and EBITDA beat; Industrial & Energy Technology (IET) orders beat consensus by up to 10% without any major LNG awards and included ~$550MM of equipment for data centers. Revenue and adjusted EBITDA were beat by +4% and +8%, with better margins in both IET and OFSE. Reinstated full-year OFSE guidance essentially matches consensus and implies an adjusted EBITDA margin of 18.5% versus 18.4% last year. Management is confident in achieving full-year order guidance of $12.5B - $14.5B (though consensus originally states $13.9B).

WFRD - A quarter way down the fairway; encouraging guidance. Revenue and adjusted EBITDA beat the street by +3% and +1%, albeit with mixed results at the segment level. Guidance for Q3 and Q4 EBITDA is 3% and 15%, respectively. Mexico plans to issue $7B to $10B of dollar-denominated, asset-backed securities that help cover arrears, including those to WFRD. Full-year 2025 FCF guidance is unchanged, implying ~$410MM at the midpoint as opposed to the $365MM consensus.

Snippet.

Chevron is cutting drilling rigs and frac crews in the Permian basin as it approaches its long-term target of producing 1 million boe/d in the region. “We’re going from growth to cash generation,” says the head of Chevron’s shale business.

That Didn’t Take Long! Chevron Reports 575 layoffs at Hess’ Houston Office (Day 2 post-close).

PPHB U.S. Energy Market Highlights:

Commodity Prices: WTI crude oil is currently $66.03 per barrel (up ~0.1% week-over-week) and natural gas is $3.15 per MMBtu (down ~12.6% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.3 MM BOPD (down ~0.2% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories decreased by ~3.2 million barrels week-over-week vs. an estimated decrease of ~1.4 million barrels.

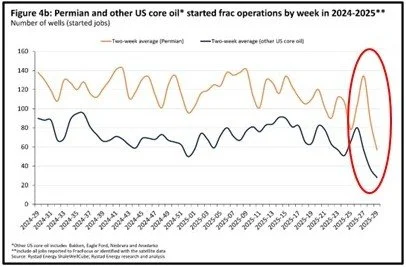

Frac Spread Count: There are currently 174 frac spreads operating in the U.S. (a decrease of 6 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 529 drilling rigs operating in the U.S. (an increase of 7 rigs week-over-week).

Movement. Last week we spoke about plastic and the problems it causes, especially in terms of the mangroves and beaches of Southern Mexico and other locations. I became a member of the Plastic Alliance. I realize we shouldn’t and couldn’t quit using plastics tomorrow, or anytime soon. But that doesn’t mean that nothing can be done. On that note, a response from a reader of my last note – “Lyondell Basell and others are implementing chemical recycling of plastic to reduce the amount of virgin plastic used in packaging. About 80 brands globally are competing for a short supply of both mechanical and chemically recycled plastic. Volumes are small today but major brands are committing to big increases in their use of recycled plastics through 2030.” Sanity and care. Thanks.

What Halliburton Said. Q3 and Q4 were guided down, as expected. Today’s outlook looks very different than just 90 days ago. The outlook was not pretty, nor known, which made it worse. One analyst asked if the market would bottom in Q3 or Q4. Had he been listening? I felt for the CEO, who responded very thoroughly with all the things that could happen and how Halliburton would handle them better than anyone. A great stump speech. Polite. As opposed to the shorter and more direct answer I would have given. Patience is a virtue. In the U.S., multiple operators are planning meaningful gaps in Q3 and Q4. NOCs are cutting back, and the corporate reorganization from acquisitions isn’t positive for the “near and medium” term. D&E might see higher margins from the seasonal sales of software, while C&P margins could drop by 20% by Q4.

The Most Critical Question – When? “Over time, oil supply and demand will balance.” We are currently over-supplied with oil, with growth coming from many places, recently including the U.S. But our production is likely to roll over after a 20% drop in drilling this year.

Great. We won’t be missed for a while, but “as things come closer into balance, prices will stabilize and oil will trade at $xxx.” That has been the argument every day for the last ten years. Halliburton’s outlook:

Advanced technology to expand returns and unconventionals will continue to be a key point.

Focus on artificial lift and all production related equipment.

Demand will arise for complex drilling and completion services, using advanced tools and automation.

How will Halliburton navigate the future it sees? From CEO Miller – “First, we will not work equipment where it does not earn economic returns, and this includes North America frac fleets. Second, we will reduce our variable and fixed cash costs over the quarters ahead to size up our business to the market we see. And, finally, we will remain focused on free cash flow and returns and will remain diligent stewards of capital.” But the future is cloudy right now. Take this for example – “We now forecast full year North America revenue to decline low double digits year-over-year.” Not good. But he does insist that Halliburton will generate returns that outpace the competition. A key but under-appreciated point - “we can operate at scale.”

Amuse Bouche. It was many years ago that I was told that the difference between the two top OFS companies was that Schlumberger would tell you what you needed to do, and Halliburton would ask if you would like some help. Collaborative.

Sep 24, 2021. 1,400 days. That is impressive. U.S. weekly reported oil production has not seen a year-over-year production decline in 1,400 days. Happy Anniversary. I’m a big fan of the implications of a second derivative calculation. We have been losing momentum for 19 weeks now. Crossing over into negative comparison territory was inevitable, especially with the rig count down. So, what now? If the market is growing, everyone can grow. If the market isn’t growing, only some will grow and some will shrink and die.

Politics. “Climate policies are blowing even larger holes in budgets. In the U.K., the Independent Office for Budget Responsibility recently estimated that the fiscal effect of moving to a carbon-neutral economy by 2050 would be more than $1 trillion, thanks mainly to the drying up of duties from gas-run vehicles.” - WSJ.

It’s the Weather. A European group released a new AI-powered weather model, and it seems to be a significant upgrade in terms of both accuracy and speed. It can spot patterns and make forecasts using far less computing power than current methods. It has shown itself to be more reliable at predicting most weather conditions. But why would being able to predict weather better matter so much? “You can use those results directly to make money,” said the CEO of a cloud computing startup that works with firms using AI to model weather and climate. Let’s see how hurricane season goes.

A Recent Photo of Biden with His Autopen.

Resolved. The Alan Dershowitz saga said, “I was Jeffrey Epstein’s lawyer. I know the facts, some of which I can’t disclose because it is privileged or subject to court-imposed sealing orders. But what I can disclose makes several important things clear.” I’ve summarized the information below:

“Epstein never created a ‘client list.’ The FBI interviewed alleged victims who named several ‘clients.’ These names have been redacted. They should be disclosed but the courts have ordered them sealed. I know who they are. They don’t include any current office owners. We don’t know whether the accusations are true. The courts have also sealed negative information about some of the accusers to protect their identities. Neither the Justice Department nor private defense lawyers are free to disregard court sealing orders. The media can and should petition the courts for the release of all names and related information so the public can draw its own conclusions.”

“There has also been speculation about incriminating videos allegedly taken by hidden cameras in Epstein’s guest bedrooms. While there were videotapes, they were taken in public areas of his Palm Beach, Florida, home. Epstein reported the theft of money and a licensed firearm from a drawer in his living room, so the police installed a video camera. I am not aware of video cameras in guest bedrooms.”

“Open records show an acquaintance between Epstein and Mr. Trump many years ago. That relationship ended when Mr. Trump reportedly banned Epstein from Mar-a-Lago, long before becoming president. I have seen nothing that would suggest anything improper or even questionable on the part of Mr. Trump.”

“It is clear from the evidence that Epstein committed suicide. What isn’t clear is whether he was assisted by jail personnel. That seems likely to me, based on the evidence of allegedly broken cameras, the transfer of his cellmate and the absence of guards during the relevant time periods.”

“I have absolutely no doubt that Epstein never worked for any intelligence agency. If he had, he would almost certainly have told me or his other lawyers who would have used that information to get him a better deal. (He wasn’t satisfied with the so-called ‘sweetheart’ deal he got, which required him to spend 1½ years in a local jail and register as a sex offender). My sources in Israel have confirmed to me that he had no connection to Israeli intelligence. That false story, recently peddled by Tucker Carlson, probably emanated from credible allegations that Robert Maxwell, father of Epstein’s former girlfriend, Ghislaine Maxwell, worked with the Mossad.”

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.