October 3, 2025

Things I Learned This Week on the Pachanga Dove Hunt

The Pachanga weekend included a golf tournament (Hance M. carried us and we got the win!), where I was forced to play with women’s clubs, and an afternoon dove hunt, where I was equipped with a youth model Stevens 20-gauge. The good news? Other than winning the golf? I didn’t get shot! That is an improvement over last year, a true first. I did not fully appreciate the “hazing” newbies got when they complained about being peppered with over a dozen pellets. There were about 30 of us, hosted by the guys from Lockton and, Northern Trust. Where you ask? The lovely town of Harlingen, Texas. The entire weekend was framed around SEC football as well. Golf, hunting, football… A weekend that’s about as good as it gets! Thanks guys.

The Biz. Consolidation and divestitures continued this week. Actual buying and selling of businesses in the oil and natural gas space is down compared to last year, though there were some mega-deals last year that make comparisons tough. Business is marginally worse than the first six months of the year, and no one wants to catch the falling knife if things haven’t bottomed, and few think they have. Close. But not yet. Layoffs continue, both for lack of activity and continuing efficiencies. And with AI becoming a more core part of every function, attrition is likely to continue at some level even when activity picks up. And it will. It is just a matter of when and by how much. We are currently “well supplied” with both crude oil and natural gas. But, between increased demand and inherent declines, some recovery is inevitable. It is all about damn timing. The most proactive thing to do? Join forces, expand capabilities, partner and work to achieve some level of scale.

Speaking of Deals. M&A activity in the U.S. land drilling rig market has not been on many people’s radar since the big 4 have made significant barriers to consolidation. But as we move down the size ranks, deals get done. Unit Corporation sold its contract drilling subsidiary, Unit Drilling, to Cactus Drilling in an all-cash deal worth $120 million. Unit now focuses on E&P. The company's fleet includes 14 land drilling rigs which operate in Texas, Oklahoma, Louisiana, New Mexico, North Dakota and Wyoming. Cactus, headquartered in OKC, has around 38 rigs and is the largest private drilling contractor in the U.S.

And Again. The Norwegian based Archer Limited is acquiring Premium Oilfield Services, a well-established U.S. well service provider within fishing and P&A-related services, for $20 million, or proforma EV/EBITDA of around 2.5x including synergies. Archer is a global energy service company with more than 50 years’ experience, 5,000 employees and operations in more than 40 locations worldwide. Additionally, they work on more than 30 offshore platforms in the North Sea and Brazil, owning two modular rigs and more than 60 mobile land rigs in Latin America. According to the company, Premium has a first-class workforce with an excellent service reputation with major operators, and their complimentary client base represents more than 80% of the estimated $15 billion that will be spent in deepwater P&A and decommissioning in the Gulf of Mexico up to 2040. And Archer, who has made a number of acquisitions over the last year, says it is not done yet.

The Economy and the Consensus. I have been reading all of the market outlook comments by a range of analysts and pundits, all who claim to have the most up to date, edgy, critical view. So, I thought I would see what the consensus was. To that, I consulted ChatGPT. The consensus outlook through 2027 indicates a period of slowing GDP growth, falling from around 2-2.3% in 2025 to roughly 1.7-1.8% by 2027. This slowdown is expected to lead to a softening labor market, with the unemployment rate gradually rising to approximately 4.4% by mid-to-late 2026 and continuing to the end of 2027. Key factors influencing this outlook include the lingering effects of higher tariffs, slower population growth, and the waning of stimulus from recent legislative acts. A slight rebound is anticipated in 2027 by some forecasts, potentially reaching 2.1% to 2.3% due to factors like looser monetary policy and tax cuts filtering through the economy. However, other forecasts, such as the Congressional Budget Office, predict sustained growth at around 1.8%.

Who’s Who. We do not give investment advice. I did that for 30 years and am not licensed to do that anymore. But I can list stocks that fit in different buckets without recommending them. The decision of whether to play and where is strictly up to you. And since we are no longer just oil and natural gas but instead the broader energy and power, we must consider the many different silos in each. This week, the nuclear industry is experiencing a dramatic return to center stage after a few decades relegated to obscurity. The renaissance underway is real and accelerating. Natural Gas will be the first choice for all additional power for the next several years with nuclear power poised to make a dramatic return. Key growth areas include small modular reactors (SMRs) and increasing demand for uranium.

Here are 15 emerging nuclear industry stocks that show potential for success, categorized by their market segment:

Small Modular Reactors (SMRs) and advanced technology

These companies are developing innovative, next-generation reactors that are smaller, more affordable, and safer than traditional nuclear plants.

NuScale Power (NYSE: SMR): A pioneer in the SMR space, NuScale is the first company to have its SMR design certified by the U.S. Nuclear Regulatory Commission. Despite regulatory approval, commercial deployment will take time.

Oklo Inc. (NYSE: OKLO): This startup specializes in micro-reactors designed to provide carbon-free power for data centers and other applications. It has attracted interest from tech giants like Amazon and Google.

BWX Technologies (NYSE: BWXT): The company manufactures nuclear components and provides reactor services primarily to the U.S. government, including the naval nuclear propulsion program. It is also developing advanced nuclear reactors and fuel.

GE Vernova (NYSE: GEV): Spun off from General Electric, GE Vernova is focused on modernizing nuclear infrastructure and is developing SMRs in partnership with other companies.

Lightbridge Corporation (NASDAQ: LTBR): This company is developing next-generation nuclear fuel that it claims can increase the power output and safety of existing reactors.

Uranium miners and producers

With nuclear power expanding, demand for uranium is projected to rise significantly. These companies are well-positioned to benefit from this trend.

Cameco Corporation (NYSE: CCJ): One of the world's largest publicly traded uranium producers, Cameco is a dominant player with a long-term supply agreements with global utilities. It also recently partnered with Brookfield to acquire Westinghouse Electric Company.

NexGen Energy (NYSE: NXE): Focused on developing a high-grade uranium project in Canada's Athabasca Basin, NexGen is a key player in the future uranium supply.

Energy Fuels Inc. (NYSE: UUUU): This U.S.-based company is a leading domestic uranium miner, with assets in several U.S. states.

Denison Mines (NYSE: DNN): A Canadian exploration and development company, Denison is advancing a high-grade uranium project in the Athabasca Basin.

Ur-Energy (NYSE: URG): This company uses environmentally friendly mining techniques to extract uranium from its U.S. deposits.

Nuclear power operators and utilities

These firms directly own and operate nuclear power plants and have significant exposure to the nuclear sector.

Constellation Energy (NASDAQ: CEG): As the largest operator of nuclear plants in the U.S., Constellation is a direct beneficiary of increased electricity demand, including from AI data centers.

Vistra Corp. (NYSE: VST): An energy company with a diversified portfolio, including significant nuclear assets, Vistra is expanding its nuclear capacity and benefiting from the AI energy boom.

Talen Energy (NYSE: TLN): Operating the Susquehanna nuclear power plant, Talen is a generator with a dedicated focus on nuclear.

Public Service Enterprise Group (PSEG) (NYSE: PEG): PSEG operates nuclear plants and is committed to a low-carbon energy future.

Energy Fuels Inc. (NYSE: UUUU): Energy Fuels is another American uranium miner and seller.

PPHB U.S. Energy Market Highlights:

Commodity Prices: WTI crude oil is currently $61.39 per barrel (down ~5.5% week-over-week) and natural gas is $3.48 per MMBtu (up ~10.9% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.5 MM BOPD (up ~1.5% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories increased by ~1.7 million barrels week-over-week vs. an estimated increase of ~1.5 million barrels.

Frac Spread Count: There are currently 179 frac spreads operating in the U.S. (an increase of 5 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 532 drilling rigs operating in the U.S. (an increase of 5 rigs week-over-week).

AI Data Centers – Who’s What. The primary builders of AI data center capacity are hyperscaled conglomerates like Microsoft, Amazon, Google and Meta, who are developing vast, specialized facilities known as "AI factories". There are also independent owners with AI startups and colocation providers contributing to the rapid expansion. The bottleneck will be power. Natural gas fired generation requires transformers and turbines that are back-ordered for years. Nuclear is also years away, though not many. So, the projects go ahead with very creative ways to use power behind the meter. Virginia leads in the number of data centers with almost 600 locations and Texas is 2nd with about 350, but these are not the huge AI data centers currently in development.

Capacity currently in operation:

At the end of 2023, there were approximately 1,000 hyperscale data centers in operation globally. The U.S. accounts for half of this capacity.

As of early 2025, cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud operate a significant number of hyperscaled centers. In 2025, ABI Research forecasts that AWS will have 135 hyperscaled data centers, Microsoft 134, and Google 130.

Other providers like Oracle also operate AI-specific centers, such as the Stargate facility in Abilene, Texas, which uses Oracle Cloud Infrastructure.

Investment commitments (announced in 2025):

Microsoft: Increased its fiscal year 2025 infrastructure spending to approximately $80 billion.

Amazon Web Services (AWS): Projected to spend over $100 billion in 2025 on infrastructure.

Google (Alphabet): Increased its 2025 capital expenditure target from $75 billion to $85 billion.

Meta: Planned capital expenditures of $60 to $65 billion for 2025.

Key project announcements:

Stargate Project: A joint initiative by OpenAI, Oracle, and SoftBank has announced plans for five new AI data centers in multiple U.S. states, with an estimated investment of over $400 billion. The locations include Texas (Milam County and Shackelford County), New Mexico, and Ohio.

NVIDIA and OpenAI: Following a $100 billion investment, this partnership aims to deploy new data centers with 10 gigawatts of computing capacity.

Massive U.S. Construction: Industry analysts noted a record-breaking $31.5 billion in data center construction capital deployment in the U.S. for 2024. The development pipeline reached nearly 50 million square feet, with some hyperscalers planning data center "campuses" requiring hundreds of megawatts of power.

Priced! We wrote recently about the huge AI Data Center being built outside of Amarillo, spear-headed by former Texas governor and Secretary of Energy Rick Perry. The company’s name is Fermi and is structured as a real estate investment trust. It went public this week, in what can only be described as a “whirlwind” effort. The company raised $682.5 million in its IPO, selling 32.5 million shares at $21 apiece, compared with its marketed range of $18 to $22 apiece. It traded up to $25 on its debut. Bookrunners were UBS, Cantor and Mizuho with Macquarie Capital, Stifel and Truist. Fermi described its business as “an advanced energy and hyperscaler development company purpose-built for the AI era” with plans to produce up to 11 gigawatts of power eventually, with 1 gigawatt expected to be up and running by the end of next year. Fermi has a long-term lease on 5,263 acres outside of Amarillo and is capable of housing four large data center campuses in its “Project Matador” development. The company plans to use natural gas, solar and nuclear for its power source. The company bought more than 600 megawatts of natural gas generation assets in two different deals, giving them a total of nine natural gas turbines to get to the 1 gigawatt level. The company said that nuclear will become the primary source of power in the long term, with plans to add four Westinghouse AP1000 advanced Generation III+ Pressurized Water Reactors. The total cost of the project is expected to reach $25 billion.

AI Models. The language associated with AI is a lexicon of its own. “Models” or “agents” are the core and they “learn”, fed information from which analysis and determinations can be made. The phrase “notable AI models” defines these as models that have made a significant impact on AI development. Stanford University produced its 2025 AI Index report that shows:

United States: Produced 40 notable AI models.

China: Produced 15 notable AI models.

Europe: Produced 3 notable AI models.

In 2024, U.S. private AI investment reached $109.1 billion, which was nearly 12 times China's investment of $9.3 billion and 24 times the UK's investment of $4.5 billion.

Gone Too Far. It is not okay for violence or threats of violence to alter our way of life. We cannot live in fear of the few deranged people out there. So, the entire issue went way too far this week. Octoberfest in Munich was closed due to a bomb threat after a bomber blew up a house and threatened to do the same to the event. The shutdown has so far been temporary and should hopefully be back, in full swing, by the time you read this. But this level of life interruption has got to stop.

Back in the Game. In 2015, Conoco announced it was pulling out of offshore deepwater development over the next two years and has instead focused its attention on the Permian. Then it bought Marathon Oil and got back into the international offshore business. Earlier this year, it sold the Marathon stake in the Gulf of America's Ursa and Europa fields to Shell. But it also got Equatorial Guinea. There, Conoco appears to be doubling down on natural gas. It signed on to be a partner in the country’s gas mega hub project and developed two offshore blocks, at a cost of $9 billion for the blocks. These blocks are expected to produce 3.5 Tcf of natural gas over a span of 20 years. The goal is to make EQ the regional gas processing hub by providing additional capacity for its Punta Europa LNG export and gas processing hub.

Industry Speaks. At the Energy Workforce & Technology Council’s (EWTC) 2025 Business Optimization Conference, leaders spotlighted two urgent priorities for the oilfield services sector, which are meeting surging global power demand with U.S. LNG and navigating policy and workforce hurdles to sustain growth. Co-President Tim Tarpley detailed EWTC’s dual policy priorities:

Permitting reform: fixing and narrowing NEPA reviews, limiting judicial challenges and accelerating approvals for critical infrastructure.

Trade and tariffs: addressing IEEPA tariffs and Section 232 tariffs on steel and aluminum, which he said raise costs for U.S. manufacturers and, ultimately, consumers.

Studied Opinion. An industry analyst, well known to me, had the following observations and commentary following Weatherford’s technology conference last week:

“Increasing price target again. We are incrementally positive after attending WFRD’s FWRD 2025 Technology Conference yesterday. Guidance for ‘25 is intact, which implies upside to consensus and our estimates in 4Q25. While the next 9 - 12 months look “sluggish,” mgmt is optimistic about the latter part of ’26 given indications for higher offshore activity and some recovery in Saudi Arabia and Mexico. We are increasingly comfortable that new technology and WFRD’s continuous margin focus will support stable margins next year, even if revenue is down modestly. We are increasing our price target to $78 (from $74) assuming a '26 EV/EBITDA multiple of 6.0x (up from 5.75x) given improving FCF conversion following its recent refinancing that should drive multiple expansion. Our new target implies a '26 levered FCF yield of ~8.5%, notably higher than comparables.”

Market Outlook. Rystad Energy's Activity Metrics Report by the OFS team is out with their latest views on U.S. onshore. I think this is basically consensus at this point, but they spell it out well.

There could be further cuts to drilling and completions (D&C) programs in 2026. Horizontal drilling is forecast to decline by 8% to 10,552 in 2025, while completions are likely to slightly outpace drilling losses, falling by 9% to 10,494.

The U.S. Lower 48 D&C activity will continue to slip further in 2026, driven by WTI prices averaging below $60 per barrel range. Natural gas prices are expected to remain near the low-$4.00 per MMBtu range next year, prompting no significant rig additions in key gas-producing regions.

There is still some pessimism among operators regarding 2026 due to downside risk in commodity prices. The market has likely bottomed out if oil prices stay above $60 per barrel, but further declines are expected if prices trend below that mark.

U.S. E&Ps are expected to move into maintenance mode in 2026, given the softness in the macro environment and concerns around inventory exhaustion.

Operators will likely delay finalizing their 2026 plans due to uncertainty around oil and gas prices. A weaker OFS industry allows them the flexibility to delay signing contracts and committing to work.

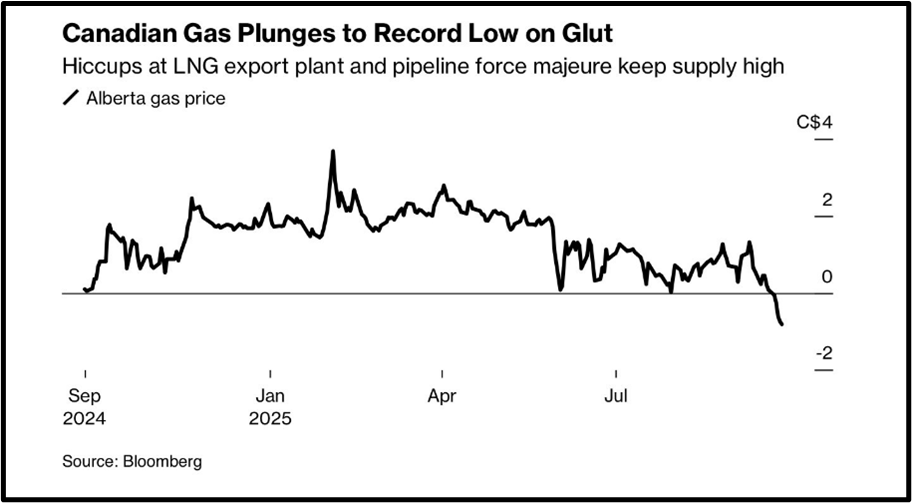

Can’t Give It Away. Canada has started up its first LNG liquefaction facility on the West Coast, but it is ramping up very slowly, using less gas than the industry has geared up to produce. Seasonal and economic demand remains weak and uncertainty in the economy persists. What has that meant for Canada’s natural gas benchmark, AECO? It closed in negative territory for seven straight days, from September 11 to September 28. Don’t misunderstand. Permian’s Waha has seen negative prices several times this year. It’s not just infrastructure bottlenecks, but that we produce a great deal of natural gas and can increase supply fairly quickly. Earlier this year, a group of natural gas-focused CEOs said that $4.50 gas and 35 rigs could meet the 25% estimated production growth by 2030. Lots of gas. And Beano doesn’t work.

Can Sell It? Store It. A Canadian IPO hit the market this week. Rockpoint Gas Storage (RGSI.TO) officially launched its IPO on October 1, 2025, with a target offering price between C$19.00 and C$22.00 per share, aiming to raise between C$418 million and C$484 million in gross proceeds.

Rockpoint Gas Storage is the largest independent pure-play operator of natural gas storage facilities in North America, owning and operating six facilities, with a combined working gas storage of 280 Bcf. The company is headquartered in Calgary, Alberta.

Real Costs. The U.S. Treasury last year estimated the two biggest energy-related credits, used primarily to subsidize wind and solar projects, would cost taxpayers $425 billion over the next decade. This has obviously been cut by the actions of the current administration. That means, instead of taxpayers taking the hit, individual projects will cost more and likely lead to higher prices among ratepayers. But with a much more direct hit than spreading the bill across all taxpayers. Putting the responsibility back into more local hands has got to be a positive.

Really? China announced it would cut greenhouse gases by 7% to 10% from their peak by 2035, but we obviously haven’t reached peak yet and the government didn’t tell anyone what that peak would be. The pledge implies a 6x expansion of wind and solar by 2035 to reach 30% clean energy by that time. But with over 100 gas-fired and coal-fired power plants in 2024, and again looking at the chart below, you have to take those comments with a giant grain of salt.

Amortized Over How Long? South Dakota is set to spend the most money on a project ever in its history. A new prison. The dramatic part, of course, is that the old prison is 140 years old and was built when this was still the Dakota Territory, not even a state. The price tag is $650 million for a new facility. Do they amortize that over the next 140 years as well?

Wow. The EPA has decided that if a wildlife species resembles an endangered species, but isn’t, that resemblance is no longer a valid reason to restrict access to land it inhabits. You would think, in the day and age of “high science,” that looking like an endangered species would not be enough to warrant restrictions. Yet for decades, pumas, the Sonoran population of the desert tortoise, four kinds of map turtles (11 species in all) have been protected for years because of their similarity in appearance to endangered species, even though they were not endangered themselves.

Recognize Any? First Brands went bankrupt last week. The company has been on a tear making acquisitions of brand names and had incurred billions in debt. There was about $2.3 billion in off-balance-sheet financing from factoring agreements and supply chain financings. Then in August, a $6 billion debt refinancing was stopped after these concerns arose, and one of its key financing partners grabbed a large chunk of the company’s cash. Too much debt, too much opaque debt and factoring receivables too aggressively were all the primary problems. Tariffs and uncertainty in the auto business didn’t help either. Take a lesson.

Snippets:

Bitcoin is up over 70% this year.

The Meta Data Center in Louisiana is the size of 94 football fields.

Berkshire Hathaway is buying OxyChem unit for $9.7 billion in cash.

Caution Flag. Under the heading of all things AI, we’ve made the point recently that a number of jobs will be lost because of AI implementation across industries and of course, some jobs will be created. But if the goal of AI is to make business significantly more efficient, then it would appear the loss of jobs may exceed the addition of jobs. My personal concern is that the least capable, those with the fewest higher-technology skills, will be the ones who lose their jobs. This comes at a time when school systems, including those in Texas, are dumbing down the curriculum to improve graduation rates, pushing more high school and college graduates into the workforce less prepared than we know they need to be. This essentially creates an underclass and widens the divide between the haves and have-nots. To me, that is the biggest issue with AI implementation. The reality is that businesses have little choice but to embrace AI and the efficiencies it brings to improve returns for shareholders. So it was not exactly encouraging when the head of Walmart, the country’s largest private employer, made pointed assessments about AI’s likely impact on employment. This isn’t new. Ford, JP Morgan Chase and Amazon have bluntly acknowledged job losses associated with AI. But when the CEO of Walmart says, “Maybe there’s a job in the world that AI won’t change, but I haven’t thought of it,” you have to start paying attention. Beware of the social and economic impacts. While that is true of any technological shift, this may be the most dramatic we’ve seen.

A Disaster? The Texas State fair is underway and while deep-fried bacon and other delicacies make their annual appearance, the lowly, and my favorite, corn dog will always be the star. So, you can imagine how shocked I was to find out that 58,000,000 pounds of corn dogs are being recalled across the U.S. And yes, it turns out the products being recalled were made in Texas. I haven’t made it to the State Fair yet, but if I show up and they’re out of corn dogs, well, that just won’t be acceptable. Apparently, the wooden stick may have a splinter or two embedded in the batter. I always thought wood was roughage. Jimmy Dean’s pancakes and sausage on a stick were also recalled. On that one, I don’t really care. I’ve always been a fan of Jimmy Dean, but pancakes and sausage on a stick was taking it a bit too far. A corn dog with mustard, though, as good as it gets. I’ll report back after my visit to the fair. We’ll see how far this recall goes. P.S. One winner this year that has to be tried is the Wagyu Bacon Cheeseburger Deviled Egg Sliders.

Life Goes On. The value of life is viewed differently in different places, and disasters can have many causes. So, when I read about a stampede of people at a rally for a popular Indian actor and political candidate that killed 40 people and injured another 124 who were hospitalized, I couldn’t help but think about how worse that is than nearly any political rally we see here. What surprised me just as much was that the local minister agreed to pay $11,000 to the families of the dead. Forty people killed, 124 in hospital and $11,000 a person. By the way, this was in India.

Paying the Piper. As has been noted before, the cancellation of wind projects on the East Coast started before President Trump was elected. The wind companies negotiated power prices with public utilities as far back as 2019 so they could use those contracts to get project financing to build their offshore wind farms. After four or five years, the costs of these projects have escalated to the point that many have been canceled, with operators facing a choice between open and lose money for the next 20 to 30 years or cancel the project now. We’ve had conversations with people about what this means for electricity supply on the East Coast. A number of states were counting on this wind power and now can’t. This is no big surprise, but the real impact is only starting to be felt, with discussion this week spilling into the New Jersey governor’s race. First of all, we’ve had five large coal plants and one nuclear reactor shut down in New Jersey in the last eight years. They won’t allow pipelines to bring natural gas to New Jersey, New York and other states in the region. So, what can be done? In typical fashion, sue someone. Jersey is now suing the regional grid and the federal government, demanding they fund additional affordable, clean energy. This comes as clean energy has already driven up power bills in the regions. Nationwide, residential electricity rates have increased 32% over the last five years, but California and New Jersey prices are up 63% and 53% respectively. They don’t want fossil fuels and they are paying a significant premium as a result. The problem is, voters don’t like paying increasingly high prices, especially when other regions are enjoying the benefit of lower prices. We’ve written before about how one of the regional grid companies uses capacity auctions to ensure plants can provide power. It made news in 2023 when payments by utilities to these auctions jumped to $16 billion from around $2 billion the year before. We can talk about the benefits of cheap renewable power, but we also have to talk about the drawbacks. People can argue on both sides, but elections are when people start to pay real attention, or when they open the envelope with their monthly power bill. New Jersey’s natural gas plants have paid 35% more for fuel this year than the nationwide average. Eventually, it catches people’s attention. Maybe instead of finding new people to sue and blame, we could fix our policies. Of course, I’m a wide-eyed optimist.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.