September 26, 2025

Things I Learned This Week While looking at the Gulf of America

Okay, I will grant you that it is a bit of sarcastic humor, but the International Association of Drilling Contractors held their annual meeting this week in Naples, Florida, a place I had never been before. Waking up to a view of the ocean, or rather the Gulf, every day was great. So was the conference.

IADC. I was the closing commentator with the assignment of “Market Outlook.” Though the idea of me correcting all the previous speakers, who covered rigs, production, prices and regulation, was tempting, there was little I disagreed with. Business is slow for everyone but deepwater drillers, and while not slow, it is not exactly robust either. The attitudes were fine, but everyone realized that layoffs were not over. Still, the mood was positive and optimistic, with everyone acknowledging that oil and natural gas production will remain a “critical firing pin” for the global economy for some time. But near term…

Welcome to the Dallas Fed. The Dallas bank does a quarterly survey on the health of the oil and gas industry, polling 93 exploration and production firms and 46 oilfield services firms. Notable findings:

Activity in the oil and gas sector declined slightly in the third quarter of 2025.

The business activity index for the sector remained negative but edged up in the third quarter.

The company outlook index fell, suggesting pessimism among firms.

The outlook uncertainty index remained elevated but edged down.

Oil and gas production declined slightly in the third quarter.

Firms reported rising costs, with all series above their averages. Among oilfield services firms, input costs rose but at a slightly slower pace than the previous quarter. Among E&P firms, both the finding and development costs index and the lease operating expenses index increased.

Oilfield services firms reported modest deterioration in nearly all indicators. The equipment utilization index for oilfield services firms fell slightly and the operating margin index was relatively unchanged, indicating margins compressed at a similar rate. Meanwhile, the prices received for services index declined slightly.

Demand for employees was relatively unchanged, as were hours worked. The aggregate wages and benefits index was also relatively unchanged.

Inflation. Unleaded regular gasoline costing $1.25 in 1980 would cost $3.50 in 2025 for an equivalent purchase. Compared to the overall inflation rate of 3.07% during this same period, inflation for unleaded regular gasoline was lower.

Progress. There were reports several weeks ago about Exxon holding talks with Rosneft, the Russian oil company. Exxon was discussing how to get paid for the $4.6 billion in value that was nationalized back in 2022, when its 30% operator stake in the Sakhalin-1 oil and gas project off Russia's Pacific coast was seized. Both Biden and Trump had given the company permission to talk to Rosneft about the issue, so there’s no partisan slant here. Now we hear that Rosneft has signed a non-binding initial agreement to help Exxon. I’m not really sure how they plan to do that and I wouldn’t expect much progress until the war with Ukraine is over, but…

Capitalism Hits Greeks. Rushtok. That is the new term. It started with some videos of sorority girls dancing in front of their sorority house, but in the age of influencers, their impact was massive. At the University of Arizona, one sorority did a choreographed dance set to a Gwen Stefani song and got 38 million views on TikTok. While someone on campus may bash capitalism, the sororities decided to embrace it. Now sorority rush is almost an audition. Dozens of sororities at schools across the country have jumped on the bandwagon and social media platforms are paying large sums of money for sorority girls to promote their products. Sorority influencers. What’s interesting is that sorority enrollment, or recruitment registrations, are up 13% over the last two years, in part due to the influence of social media. A senior at the University of Alabama, a Zeta, now has 1.3 million followers on TikTok and is making $1 million a year. I painted houses and dormitories to make it through college. If I had only known.

Foreshadowing? The first line of the story read, “Ford Motor is racing to sell more F-150 pickups this quarter by offering ultra-low interest rates to buyers with low credit scores.” Subprime, here we come. One problem, of course, is the cost of new vehicles. Seven year auto loans are now common. The program isn’t expected to continue beyond the end of the month, but the company has already set the tone for what it will do and continuing that would be easy. That’s the slippery slope. Recently, a subprime auto lender, Tricolor, filed for bankruptcy, with more than 100,000 of its borrowers lacking a Social Security number or any credit history at all. Not much sympathy there. The average price of a new car is up 30% in the last five years, and of course, the tariffs. The fear of tariffs allow companies to raise prices further. It costs on average $50,000 to buy a new car and according to one study, the all-in cost of ownership is over $1,000 a month. And it’s only transportation.

Cheap or Not. A headline that surprises no one. “Mitsubishi Heavy Industries to Double Gas Turbine Capacity.” Between the lack of transformers and turbines, the AI power effort faces some headwinds. We have been told that some turbine backlogs are now 70 months, and two years is very common. The same can be said of Eaton and others in the transformer business. Transformers and Turbines. Is the sector overvalued? Only time will tell. The biggest concern? Double ordering. When equipment is tight and delivery times are long, buyers often place orders with more than one and sometimes several different suppliers. How much of the current order books in the industry are “double-booked” is unknown, but we would expect to see companies bidding up in the line for earlier delivery.

Eaton (ETN): Current PE multiple of 37.5x – 37.7x and an EV/EBITDA multiple of 26x. The five-year trailing PE has ranged from 27.5x to 35.3x, with a five-year average EV/EBITDA multiple of 21x.

Caterpillar (CAT): Current PE multiple of 23.4x – 23.9x and an EV/EBITDA multiple of 17x. The five-year trailing valuation range is from 16.8x to 21.3x, with a five-year average EV/EBITDA average of 14x.

Powerhouse. Nabors, one of the largest land rig contractors, has put a new rig to work. It is billed at HUGE. The natural gas-powered walking rig includes a 1-million-pound mast rating, pipe-racking capacity of up to 35,000 ft and three 2,000-horsepower mud pumps capable of 10,000 psi pressure. Torque is 65,000 ft-lb; hoisting, 1 million pounds; setback, 1 million pounds; and power generation capacity, 6,000 kilowatts (kW). It has gone to work with Caturus Energy, part of the Kimmeridge family, whose executives said the PACE-X Ultra Rig X33 is “the most powerful onshore drilling system currently in the U.S.” “The rig itself is about 25% more capable than every other rig that’s currently on the market,” said Eric Kolstad, Caturus VP of Wells. The racking capacity will allow longer laterals of four miles at deeper depths of more than 14,000 ft vertically in high-pressure and high-temperature formations. Nothing stays proprietary for long in the drilling business, and some competitors may toss rocks at it, but the improving capability of the drilling rig fleet continues to be impressive, as it drives efficiency across the board.

Next? Honda announced it is immediately ending production of its ZDX electric SUV, saying that it wants to “better align our product portfolio with the needs of our customers and market conditions.” And so it begins.

Blowing. While President Trump is slowing wind on the East Coast, Europe is still moving ahead. A $5.3 billion tender from the French government to build and operate the country‘s largest offshore wind farm has been awarded to TotalEnergies and its partners. The project will be a 1.5 GW wind farm off the coast of Normandy, providing electricity to more than 1 million households. They still have their nukes, so this is a positive addition.

Shifting Dollars. The U.S. Treasury last year estimated that the two biggest energy-related credits, used primarily to subsidize wind and solar projects, would cost taxpayers $425 billion over the next decade. This has obviously been cut by the actions of the current administration. That means instead of taxpayers taking the hit, individual projects will cost more. This will likely lead to higher prices among ratepayers. But this is much more direct than having all taxpayers foot the bill. Putting the responsibility back into more local hands has got to be a positive.

Really? China announced it would cut greenhouse gases by 7% to 10% from their peak by 2035. But as the chart below shows, we obviously haven’t reached peak yet and the government didn’t tell anyone what that peak would be. The plan represents a 6x expansion of wind and solar by 2035 to get to 30% clean energy. But with over 100 gas-fired and coal-fired power plants added in 2024, and again looking at the chart below, you have to take the comments with a giant grain of salt.

PPHB U.S. Energy Market Highlights.

Commodity Prices: WTI crude oil is currently $64.99 per barrel (up ~2.7% week-over-week) and natural gas is $3.13 per MMBtu (down ~3.1% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.5 MM BOPD (up ~2.3% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories decreased by ~1.0 million barrels week-over-week vs. an estimated increase of ~1.0 million barrels.

Frac Spread Count: There are currently 174 frac spreads operating in the U.S. (an increase of 5 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 524 drilling rigs operating in the U.S. (an increase of 3 rigs week-over-week).

Hot Money. South Dakota is set to spend the most money on a project ever in its history— a new prison. The dramatic part of that of course is the old prison is 140 years old and built when this was still a territory and not even a state. $650 million for a new prison. Do they amortize that over the next 140 years as well?

Fees and Taxes. A recent stay at a hotel in Aspen (for C. Durpre’s party!) was great, but the bill surprised me. You must give them credit for being creative. The argument has been that the locals aren’t being taxed, only visitors. But if everyone reciprocates….

Oil. U.S. commercial crude oil inventories fell by 607,000 bbl from the previous week. At 414.75 million bbl, U.S. commercial crude oil inventories were about 4% below the 5-year average for this time of year, the lowest since April. This has pushed crude oil to $65/barrel, the highest since early September. Point being, stunningly low inventory levels have little impact on oil prices.

Conspiracy Theory. The Pentagon has summoned military officials from around the world for a gathering in Virginia. Top generals and their staffs don’t know the reason for the meeting. Invasion of Venezuela?

John Wick 5. I have to admit, I thought the following headline was pretty funny." Maduro urges Trump to engage in direct talks amid rising tensions." Tensions? We just boosted the bounty on his head to $50 million. If someone put a contract out on me for a hit and offered to pay $50 million, I wouldn’t rush to chat with them either. Maybe get them to change their mind. Creative thinking!

Good Idea. All adults will be issued with digital ID cards under plans by UK Prime Minister Sir Keir Starmer to tackle illegal immigration. Called the “Brit card”, anyone seeking to start a new job or rent a property would be required to present their digital ID, which would then be checked automatically against a central database of individuals entitled to work in the UK.

Changing Climate. Last week was Climate Week in NYC, but it looked different this year. If you remember, the head of the UK, the UN and President Biden among others were pushing banks and other lenders to stop funding hydrocarbon development. Many of the major banks signed up for the UN’s Net-Zero Banking Alliance (NZBA), which started about four years ago. That is until AI came along with its power needs. So far, Bank of America, JPMorgan Chase, Goldman Sachs, Citigroup, Morgan Stanley, Wells Fargo, HSBC, Barclays and the six largest Canadian banks have withdrawn from the Banking Alliance. The huge amounts of energy required for data centers and AI chips made it moot. We need energy security more than we need net zero, it seems. “The green premium is gone, as has a lot of the fluff and froth, so the only things that will get funded are those that make economic sense,” said a former Blackstone Executive. Bankers are now fighting for the opportunity to help add to the supply of energy. While much of it is much more palatable low-carbon energy, it is still financing and primarily for natural gas-fired power. When the banks change stripes, it’s a new ball game.

Corroboration. My friend Robert Bryce has a piece out on SMRs. Anyone who has been reading this news letter for any period of time knows that I am very bullish on the future of nuclear, especially with regards to small modular reactors. I bet someone last week that we will have 100 more nuclear generation facilities in 12 years. I would take the over on the bet. One of his main points is that many of the current SMR companies have seen valuation runs that are very hard to justify. $10 billion market cap for a company that won’t generate revenues for another 8-10 years. But the valuation does show the growth potential that many people believe the sector has. According to one estimate, the SMR market could be worth $150 billion between now and 2040. Another estimate put it at nearly twice that number. The International Atomic Energy Agency estimates there are more than 90 SMR designs. The contenders are pushing a dizzying array of sizes, fuels and strategies. There may be issues with stock valuations, but the demand, need and growth are pretty much etched in stone.

NIMBY. We were all surprised when it took ages to get the Schlumberger (SLB)/ChampionX deal done. Norway and other countries objected, even though the U.S. gave it their stamp of approval. Now, two oil companies and one service company oppose the competition. ExxonMobil, Petrobras and contractor TechnipFMC have petitioned Brazil's antitrust watchdog to oppose a merger between Italy's Saipem SpA and Norway's Subsea7. The combination would have a significant impact on competition in the oilfield services industry and could cause prices to increase, according to the companies challenging the deal. Specifically mentioned were the markets for subsea umbilicals, risers, and flowlines, known as SURF, as well as pipe laying vessels. “The transaction reduces choice for Exxon and other customers to a single relevant supplier in the deepwater pipeline installation market.” Combined, the two companies would have 47% of the total number of vessels available for servicing its subsea engineering, procurement, construction and installation contracts.

And Robert Again. I have a huge amount of respect for my friend Robert Bryce, and I share his “distaste” for over-subsidized wind and solar projects. He keeps a NIMBY list of cancelled projects, with the total value reaching close to what must be a gazillion! But this worries me. Several of the projects on the east coast, even before Mr. Trump’s efforts and prices that were negotiated in 2019, were no longer economically feasible. So, they are now getting shut down, with no hope of renegotiated terms. Now, even the Revolution Project, which is ~80% complete, may never open. What had been a contracted supply is now considerably short, with New Jersey, New York, Massachusetts and Rhode Island all impacted. Alternative supply chains take some time to set up. Gas-fired power from the Marcellus?? Just because it makes sense doesn’t mean it will happen.

Cut Back. To further my Venezuela invasion conspiracy theory, the latest move by the administration is to put the screws on Maduro financially since Chevron is only able to export about half the crude its joint ventures produce in Venezuela. The Treasury said that it banned any payment, in any currency, to the government of President Maduro. Now Chevron will export only 120,000 barrels per day. For a country with more oil than Saudi Arabia, that is amazing. The reason? Stopping the Maduro regime from gaining more access to capital. Good move.

Debt Redux. Transocean surprised the market this week by announcing a stock offering to raise about $325 million. The proceeds will be used to pay down some of its 8% debt due in 2027. The stock got slapped, but you raise capital when you can, not just when you need to. The company has been doing debt swaps for some time while they tried to stay out of bankruptcy. 2027 is not very far away, and they will reduce interest payments by ~$26 million a year. Of course, the combination of RIG and Seadrill would be a deleveraging event for RIG. It might happen. Weatherford jumped on the bandwagon as well and upsized a $600 million debt offering to $1.2 billion, 6.75% of senior notes due 2033 at par. Weatherford expects to save about the same amount, ~$25 million from the debt reduction, refinancing $1.2 of their $1.6 billion of debt.

Correction. Last week we wrote about the giant data center being developed outside of Abilene by former governor and Energy Secretary Rick Perry. It should have been Amarillo. Natural gas will be the original power source, pulled from two nearby pipes, with the idea of transitioning to nuclear as soon as practical. Meta, owner of Instagram and Facebook, is building what is billed as the largest data center in the Western Hemisphere, on a site in rural northeastern Louisiana. It won’t be the biggest for long.

Working Out of a Job. At the IADC meeting it was mentioned that it had taken 26.25 days for Exxon to drill a well. Management said to bring them ideas on how that can be reduced. But you are asking companies to bring ideas on how they can get paid less, have lower utilization and lower financial returns. Not exactly prime motivation. Similarly, one contractor said he wished U.S. production would roll over.

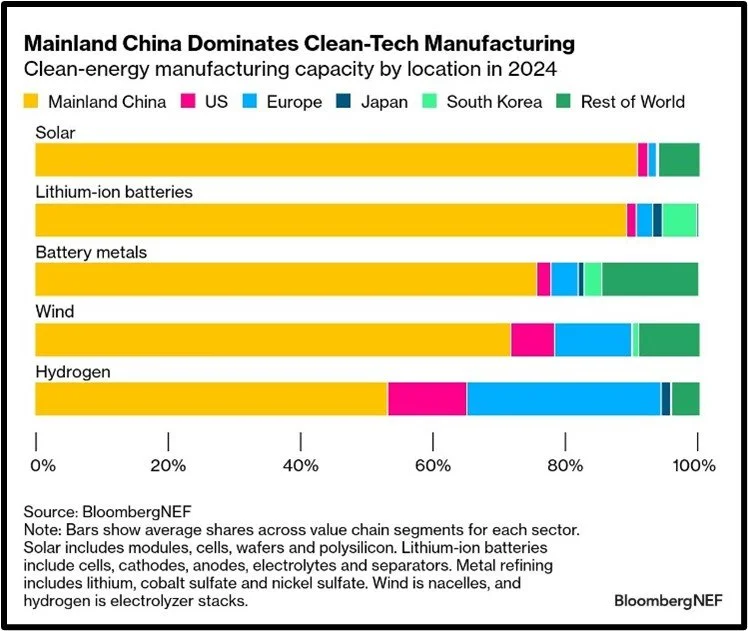

Made Where? We have a slide in our deck showing China being the lead and top grower of global CO2 emissions. Over 100 coal-fired power plants were put online last year alone. But in terms of making stuff, they dominate. As great as our energy activity is for our U.S. economy, we could still be doing more. We need to develop more manufacturing here. It is fine to outsource that manufacturing to cheap labor, until the cheap labor controls the relationship to their increasing favor.

Money Money. While BRICS members have not launched a joint currency, they are accelerating moves away from the dollar in other ways:

Increasing Local Currency Trade: Trade among BRICS nations in their own currencies has increased significantly. For example, some bilateral energy deals are now settled in yuan or rubles.

Developing Payment Systems: BRICS nations are developing BRICS Pay, a cross-border payment platform that will bypass the western-dominated SWIFT system. This platform is expected to facilitate transactions in national currencies.

Pursuing De-dollarization: The expansion of BRICS, which now includes members like Iran and the UAE, is viewed as a strategic step toward lessening dependence on the U.S. dollar. Central banks in BRICS countries have also been increasing their gold purchases.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.