September 19, 2025

Things I Learned This Week Between Moonshiners and Rednecks

Busy. It has been an interesting week. The Fed lowered rates, while the UK didn’t. Charlie Kirk has a much broader appeal than some realized, including Jimmy Kimmel. Oil and gas prices stayed flat, as did most activity indicators, scraping along a cyclical bottom. On the positive side, I had a very successful fly-fishing trip to North Carolina, home of moonshiners, with a great friend (26 fish!) and then ended up in Amarillo for the 96th annual Panhandle Producers & Royalty Owners Association meeting. They aren’t really rednecks! Among the speakers were Marshall Atkins and me. You should have been there! Marshall focused on inventories and actual shipped production by OPEC+, noting that we should be approaching balance and expecting higher prices by 2027. We also observed that “doing more with less” is still advancing in the industry.

Interesting Trip. One of the speakers right before me was Wayne Christian, the 50th Texas Railroad Commissioner. He is also a Grammy-nominated gospel singer! We had dinner the night before. He observed that seven large international companies are setting the agenda for Texas, while small local producers, who account for more than 83% of U.S. oil production and drill over 90% of all wells, are not well represented on many rule-making bodies. He made some very good points. The small oil and gas producer is losing sway to the seven behemoths, which are shaping rules to benefit themselves.

Optimism. We in the oil and natural gas industry are generally optimists. There might be a curmudgeon engineer or two around, but we are a positive group. The current market makes it hard, and that was evident in Amarillo. The Panhandle has no real shale and some of its largest fields have been producing for decades. At $63 oil and $2.75 natural gas, activity is not spurred, but everyone was still happy and upbeat, having endured tough cycles before. It was a great meeting. Marshall got everyone excited and optimistic. I just pointed at him and echoed, “what he said.” I got out alive.

Conferences are Starting. It is that time of year. We are still seeing mainly hedge funds. One CEO noted seeing one new institutional investor covering energy at a recent conference. As long as you say things like “power and energy” and “AI data centers,” and stay away from “oil & natural gas,” it seems to work better. Investors often try and buy a sector before the improvement is obvious, but too many energy investors have had their faces ripped off in the last several years, leaving few willing to front-run a recovery. The futures strip is $63 for the next 12 months, so the likelihood of 2026 being meaningfully better is remote. Natural gas looks stronger, with huge slugs of demand expected from LNG and data centers. Still, with ample supply, $4 gas and 30 rigs may be the metrics needed to spur additional production. Consolidation and a continued push for technology and efficiency remain the corporate focus. Christmas is only three months away! We have to have something to look forward to.

Hurricanes. 2022, 2024 and now 2025 have been benign hurricane years, despite worries and predictions that climate change would make the season much more severe than normal. Oops.

Success and Congratulations! WaterBridge Infrastructure (symbol: WBI) priced its IPO at the top of the range and rose 14% on its first day, giving it a market cap of $2.6 billion. Well done, 5-Points! This is a positive for the industry, and we understand there will be more water equity opportunities in the coming weeks.

Dancing in the Dark. California. That very welcoming state for oil and gas. Oh. Wait. But if you have leases and production, you can’t really leave California. Unless, of course, you just sell your company to another California oil company and let them deal with the politics and bureaucracy. After the Sable Offshore issue, the California governor came down hard with new regulations for the industry. Well, at least for the offshore. He was more lenient toward onshore, ending a permitting moratorium in Kern County, but everything is relative. So, what to do? If you are Berry, you sell your 20,000 barrels per day of oil production and your 20,000 acres to another California company. And who better than California Resources? “The combination of CRC and Berry will create a stronger, more efficient California energy leader,” said the CRC President and CEO. The deal is $717 million plus the assumption of about $425 million in debt.

One House’s View. Capital One has some good analysts. I may be biased, but they are good nevertheless. A recent piece summarizes the market well.

“We are now tactically cautious on oilfield services stocks. The OIH is just -3% below its close of $266 on April 2 (Liberation Day) with the 12-month WTI strip -9% lower and consensus for ‘26 EBITDA estimates about -15% lower. Moreover, we see the risk that OPEC+ will re-accelerate supply increases given resilient U.S. liquids production and do not expect another round of sanctions to meaningfully impact Russian supply if implemented. The risk-reward profile is skewed to the downside in the short term. Persistent global demand issues, particularly in China and India where product demand is down year over year, means lower supply is needed to balance the market. This requires OPEC+ to make substantial cuts or a significant reduction in non-OPEC+ supply. Like most, we are positive regarding the outlook for natural gas demand. However, we believe the addition of ~15 rigs would add about 2.0 Bcf/d to U.S. production over one year, representing less than a 3% increase to last week’s Baker Hughes U.S. land rig count, leaving oil prices the primary driver of U.S. activity.”

Wall Street Checkbook. For over a year now, Permian Resources has held the mantle as everyone’s favorite “next takeover candidate”, and it just launched a secondary share offering this week for ~46.1 million shares, about 6% of shares outstanding, and is the 6th secondary offering since early 2023. All the stock offered comes from two shareholders who have been long term investors – Pearl Energy and Riverstone. The company is not receiving any proceeds from the planned transaction.

The Hart Energy A&D Strategy Conference was Held Last Week. The bottom line? Lots of buyers with lots of money and no sellers. According to one speaker, balance sheets are stronger than they have been in decades, but Q2 was the slowest transaction quarter since the Asian Financial Crisis in the late 1990’s. Sellers see no reason to transact. Oil is down 12% this year and, while natural gas is hot, we have a surplus that is selling well below $5/mcf. Price volatility makes it very difficult for buyers and sellers to value anything in the industry. Buyers have raised billions, and they really want to put their money to work. But the disconnect between buyers and sellers remains high. The largest oilfield services bank said that in a typical sell-side process, one sees around 30 to 40 data room participants and a solid number of bids. One banker estimates that about $10 billion worth of assets are currently being marketed for sale. Billions of dollars looking for a home. Need my address?

Concrete Movement. The following is a BBC report. I preach about nuclear energy a great deal and have for the last few years. At an SMU energy symposium, I heard a speaker who was a born-again “nukie”, and one of the smartest, most rational and most informed people I have met. I am now encouraging my college son to look hard at that industry. This article is an “analyst’s corroboration”, because it absolutely validates my own opinions. Highlights are mine.

Britain and the United States are set to sign a sweeping agreement to accelerate nuclear power development during U.S. President Donald Trump’s state visit this week, marking what Keir Starmer described as the start of a “golden age of nuclear.”

The accord, known as the Atlantic Partnership for Advanced Nuclear Energy, is designed to streamline licensing and regulatory approvals, speed up deployment of advanced reactors and unlock billions in private-sector investment across both countries.

There is a series of large-scale deals either accompanying or related to the announcement:

X-Energy and Centrica plan to build up to 12 advanced modular reactors in Hartlepool, northeast England, which could power 1.5 million homes, and create as many as 2,500 jobs, and be a cornerstone of the UK’s nuclear revival.

Holtec International, EDF and Tritax are set to repurpose the former Cottam coal-fired plant in Nottinghamshire into a massive nuclear-powered data center hub. The project, costing about $15 billion, will leverage small modular reactors (SMRs) to power the AI and digital infrastructure sector.

Rolls-Royce has entered the U.S. regulatory process for its SMR design, paving the way for deployment on both sides of the Atlantic.

Urenco is expected to supply an advanced type of low-enriched uranium to the U.S. market, part of a broader strategy to end reliance on Russian nuclear material by 2028.

Additional smaller-scale initiatives include micro modular reactor development at the London Gateway port, backed by Last Energy and DP World, with £80 million in private investment.

One of the most significant elements of the new partnership is regulatory alignment. If a reactor passes safety checks in one country, the other can use those results to support its own licensing process. This change is expected to cut average approval times to two years, down from the current three to four years.

Big Raise. We have written in the past about Orsted, the Norwegian company who is in the offshore wind construction business in the New England region. They’ve already pulled out of two projects on the east coast and they’re trying to finish other projects that are already under way. But the administration is working to slow down those efforts. Because of the issues they’ve had in the U.S. offshore wind market, they’re behind on their divestiture program of selling assets to fund their business. As a result, they announced a capital issue to raise $9.4 billion to complete some of their projects. $9.4 billion may be the largest capital raise issue I’ve ever heard of. The Revolution Wind Project, which was more than 80% finished and proceeding to completion, was shut down last month when the government ordered a stop to construction of the project off the coast of Rhode Island. Empire wind, a project off the coast of New York by Ecuador, was forced to halt work as well. “We’re raising capital to cover immediate financing needs from retaining full ownership of Sunrise Wind, manage risks from regulatory uncertainty in the U.S. and the strength and Orsted’s structure so we can deliver our growth pipeline and long-term value creation.” That was the CEO. It’s a very noble goal. $9.4 billion would solve most of my near-term financial issues. It looks like that’s what Orsted needs now. We doubt it’ll be the last raise before these Wind Projects start to work.

The Moon Alice! A recent property sale in Lea and Eddy Counties in New Mexico made headlines. A 640-acre parcel sold for $57.7 million or $90,000 per acre, and a separate and smaller 160-acre parcel went for $175,000 per acre. That is not a typo. There was an average of almost 7 bidders on every parcel. Now, just think about that for a minute. $175,000 for an acre of land, and you don’t even own the land. You are just leasing it. It’s the size of the average golf course, making it $1.6 million per hole for a full 18. For the right to play, not own it. Times have changed since shale! To better understand the effectiveness of our drilling and completions, we get about 7-8% of the oil in place out of shale, and that is generous. A conventional reservoir on average will produce 47-48% of the oil in place. Lease costs and operating costs would be significantly less. But putting four miles of perforated pipe directly in the reservoir itself versus a pipe that vertically penetrates the reservoir is such a dramatic impact to the economics of the well. $175,000? Rich, but no one is trying to lose money.

Nostalgia. David Heikkinen is “retired” but still around. I saw this yesterday and it made me feel my age. This is only E&P but if you have anything to add to the list….

“E&P companies I miss”

This is Big! Last week, the EPA proposed discontinuing the Greenhouse Gas Reporting Program (GHGRP), which requires oil and gas companies and other major polluters to track their annual emissions from over 8,000 facilities, including refineries, compressor stations and power plants. Continuing the over 20-year-old program was not "useful to fulfill any of the agency's statutory obligations." According to the head of the EPA, "The Greenhouse Gas Reporting Program is nothing more than bureaucratic red tape that does nothing to improve air quality." It is expected to save $2.4 billion in regulatory costs.

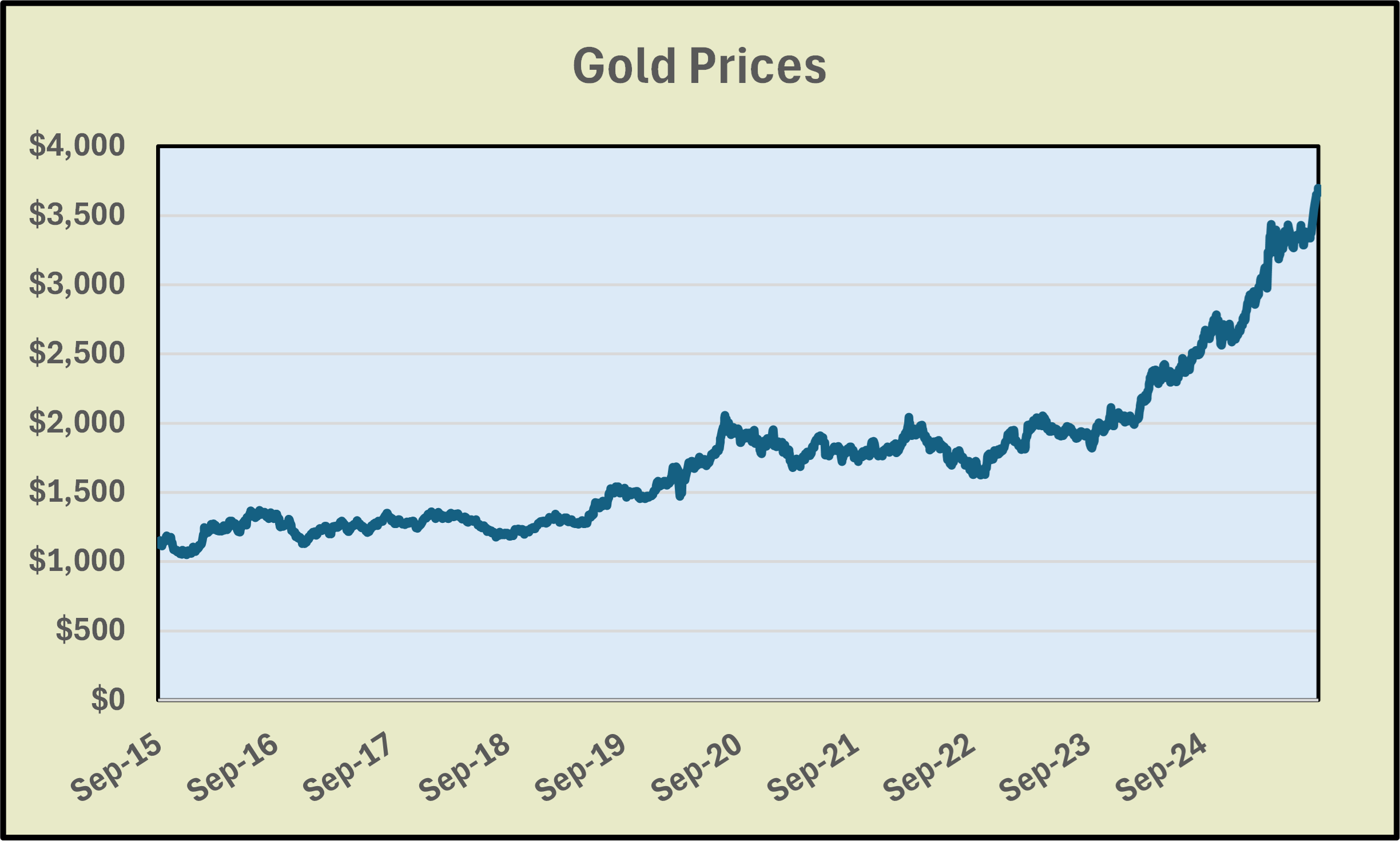

Missed the Boat??

PPHB U.S. Energy Market Highlights:

Commodity Prices: WTI crude oil is currently $63.26 per barrel (up ~0.3% week-over-week) and natural gas is $3.23 per MMBtu (down ~2.1% week-over-week).

Crude Oil Production: U.S. crude oil production is currently ~13.5 MM BOPD (up ~2.1% year-over-year).

Crude Oil Inventories: U.S. crude oil inventories decreased by ~9.2 million barrels week-over-week vs. an estimated increase of ~1.4 million barrels.

Frac Spread Count: There are currently 169 frac spreads operating in the U.S. (an increase of 5 spreads week-over-week).

Onshore Drilling Rig Count: There are currently 524 drilling rigs operating in the U.S. (an increase of 2 rigs week-over-week).

Snippets.

Weatherford announces expansion of credit facility to $1 billion (maybe they are looking to go shopping?).

Exxon has “no plans” to re-enter Russia, said CEO Darren Woods. There goes their ~$5 billion investment that got nationalized by the government.

I never learned to roller skate as a kid because our street wasn’t paved.

New P&A Rules are Impacting Economics. Texas Senate Bill 1150 was passed by the legislature and requires that any wells that are at least 25 years old and have been inactive for more than 15 years must be plugged. The new rules will take effect in September 2027. It doesn’t sound like a harsh regulation, but there are about 1,000,000 producing or recently producing wells, many drilled before 2000 that have changed hands countless times. This adds a liability that didn’t exist before, at least not on the same timeline. If I buy a batch of wells drilled in 1999 that went out of production when the price crashed, I must start putting up the money for P&A for that well, even if I hope and plan to put it back into production. There are exceptions. You can put them back into active production for one. But the schedule of putting them back into operations as more wells hitting the 25-year mark will negatively impact income and liquidity. We mentioned earlier that seven international oil companies seem to dominate many regions and boards, but they too will find it having a negative impact as they try and sell core wells from their portfolios. Karma.

Any and all comments, arguments and rebuttals are welcome!

In addition to my association with PPHB, I serve on three private company boards. Merit Advisors is a property valuation company and I have long been a fan of optimizing how a business is run, not just the tools we make. Merit is in the business of savings companies’ money, actual cash, by doing a much more in-depth and realistic view of equipment and reserve valuations and I am very impressed with their work. I am also on the advisory board of Preng & Associates, a leading executive search boutique that specializes in all things related to Energy & Power. Nova is a gas compression company run by a very dynamic CEO with a very strong board and ownership.

I serve on the Advisory board of the Energy Workforce & Technology Council (formerly PESA), the National Ocean Industries Association (NOIA), and the Maguire Energy Institute at SMU my alma mater.

jim

214-755-3914 | james.wicklund@pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.